Carlsbad Deed Records

Carlsbad property deeds are recorded with San Diego County Assessor Recorder County Clerk in San Diego. The city of Carlsbad does not have its own deed office. All real estate transactions in Carlsbad go through the county system. San Diego County maintains deed records for 18 cities including Carlsbad, San Diego, Chula Vista, and Oceanside. You can search these records online using the county's Acclaim system. Note that APN searches are no longer available online due to AB 1785 but name searches still work. Carlsbad sits on the Pacific coast in northern San Diego County about 35 miles north of downtown San Diego. The city has approximately 114,000 residents across 42 square miles. Carlsbad is known for beaches, Legoland California, and the Flower Fields.

Carlsbad Quick Facts

San Diego County Recorder

San Diego County Assessor Recorder County Clerk handles all deed filings for Carlsbad. Call (619) 237-0502 or email ARCCRecorderCountyClerk.FGG@sdcounty.ca.gov for questions about recording or copies. The office is in downtown San Diego which is about 40 miles south of Carlsbad.

The office is open Monday through Friday during regular business hours. You can submit documents in person, by mail, or through electronic recording. Most real estate professionals use eRecording because it speeds up processing compared to paper submissions.

Recording a deed creates an official public record that protects your ownership rights. Under California's race-notice system, the first person to record generally has priority. This is why buyers and lenders want deeds recorded immediately after closing.

For comprehensive information about San Diego County recording, visit the San Diego County deed records page which covers recording fees, online search instructions, eRecording information, and how to request certified copies of property documents for Carlsbad and all other San Diego County cities.

Search Carlsbad Property Records

San Diego County offers online deed searches through its Acclaim system. Go to the San Diego County online records portal to search for Carlsbad property documents. You can search by name or document number but not by APN due to AB 1785.

To search by owner name, enter the last name first. The system shows all matching records with basic information. Click a result to view more details about that deed. Some document images may be available online while others require a request to the recorder office.

APN search functionality is no longer available online. If you need to search by parcel number, you must use the in-person kiosks at the recorder office. This change was mandated by state law to protect property owner privacy.

Most Carlsbad home sales use grant deeds. These transfer ownership with implied warranties that the seller has not sold the property to anyone else. Quitclaim deeds are used for family transfers or to clear title defects. They provide no warranties about ownership.

Carlsbad Recording Costs

San Diego County charges standard recording fees that apply to all county cities including Carlsbad. The first page of a deed costs about $89 to record including base fees and mandatory state charges. Each additional page costs $3. A typical three-page deed costs $95 total.

Copy fees are $2 for the first page and 5 cents for each additional page. Certification adds $1. So a certified copy of a five-page deed costs $2.25 total. This is much lower than many California counties where certified copies can cost several dollars per page.

The SB2 fee of $75 applies to most real estate documents. This state-mandated charge funds affordable housing programs. Every California county collects it. The maximum SB2 fee is $225 for transactions involving three or more parcels.

If you use electronic recording through a vendor, the vendor may charge service fees on top of county recording fees. Most title companies include these costs in their closing services. Ask for a full breakdown before closing on Carlsbad property.

Carlsbad Transfer Tax

Carlsbad has no city transfer tax. You pay only the county documentary transfer tax of 55 cents per $500 of the sale price. For an $850,000 home, the transfer tax is $935. This is the standard rate used throughout most of California.

The seller typically pays transfer tax at closing unless the parties negotiate otherwise. The tax is based on the net consideration. If a buyer assumes an existing mortgage, that loan amount does not count toward the taxable value.

The county collects transfer tax when the deed is recorded and stamps the amount on the document. This becomes part of the public record. Anyone can see what transfer tax was paid and estimate the sale price by working backward from the tax.

Transfer tax is different from property tax. Property tax is an annual charge based on assessed value. Transfer tax is a one-time fee charged only when ownership changes. Some transfers may qualify for exemptions from transfer tax.

California Recording Fees

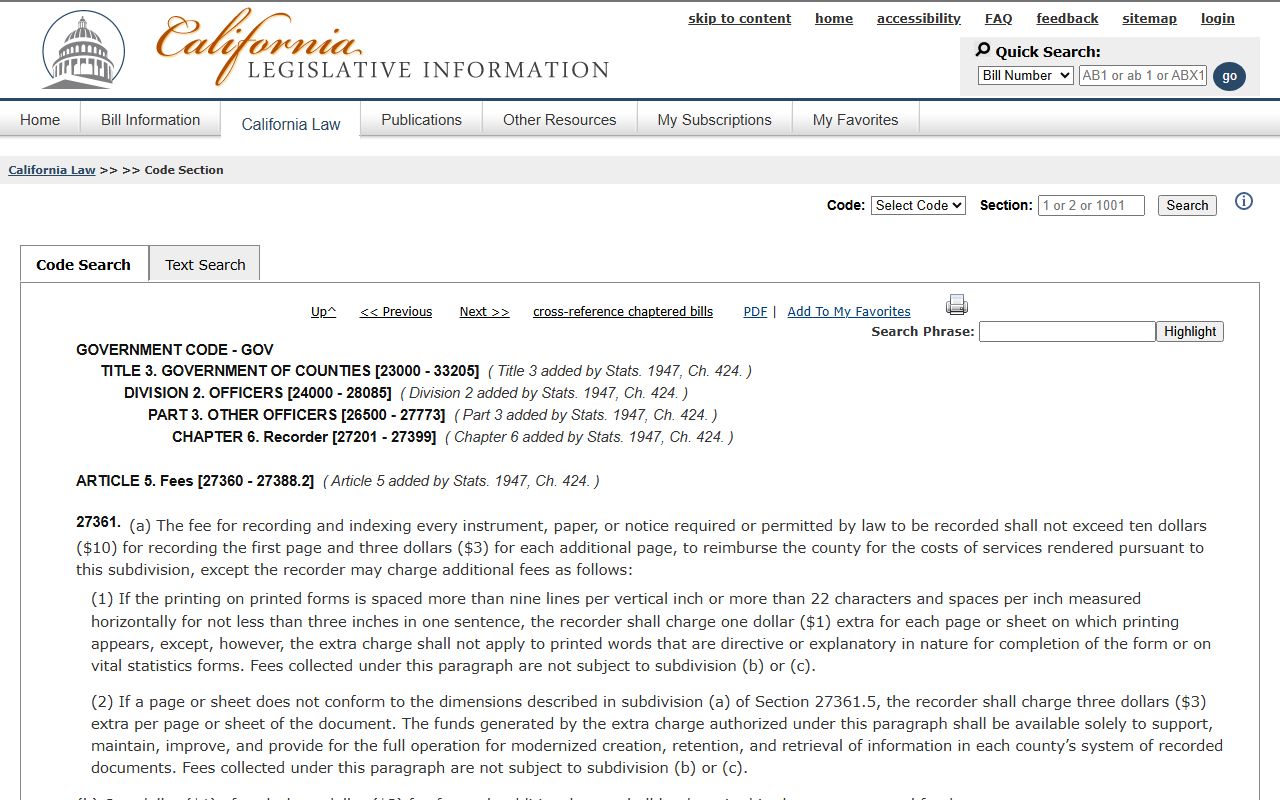

State law caps recording fees counties can charge. The California Government Code Section 27361 sets maximum fees at $10 for the first page and $3 for additional pages.

Counties can add certain mandatory fees like the SB2 housing fee and fraud prevention fee but the base recording fee must stay within these statutory limits for Carlsbad and all other California properties.

Other San Diego County Cities

San Diego County has 18 incorporated cities. All record deeds at the county office in San Diego. Below are other major cities near Carlsbad:

Recording fees and transfer tax rates are uniform across San Diego County since no city has adopted additional city transfer taxes.