Orange Deed Records

Orange deed records are maintained by the Orange County Recorder located in Santa Ana. The city of Orange has no deed recording office. All property documents for Orange get filed at the county level. Orange County handles recording for 34 cities including Orange, Anaheim, Irvine, and Santa Ana. The county has recorded over 11 million documents electronically since launching eRecording. You can search the online database back several decades or visit the recorder office for older files. Orange is a city of about 139,000 people located in northern Orange County, known for its historic Old Towne district with antique shops and vintage buildings.

Orange Quick Facts

Orange County Recording Office

Orange County Recorder handles all deed filings for the city of Orange. The office sits at 601 North Ross Street in Santa Ana, about 7 miles south of Orange. You can call 714-834-5043 or the toll-free number 855-886-5400. The office is open for walk-in service during regular business hours.

When you buy or sell property in Orange, the deed must be recorded at this county office. Recording creates a public record that protects your ownership rights. The county stamps each deed with the official recording date and time, assigns a unique document number, and indexes it by the names of both the buyer and seller.

Most deeds get submitted through eRecording now. Title companies use certified vendors to send documents electronically. This speeds up processing and cuts down on errors from unclear handwriting or missing pages. If you prefer paper, you can mail documents to the recorder or take them in person.

For more details about Orange County recording, visit the Orange County deed records page where you can find complete fee information, links to the online search portal, instructions for requesting certified copies, and details about how the county processes over 11 million documents through its electronic recording system.

Search Orange Property Records

Orange County provides free online access to recorded documents through RecorderWorks. Go to the Orange County online records search to look up deeds by owner name, address, or document number. The system covers many years of records with images you can view on screen.

To search by name, enter the last name first. The system returns all matches. Click on a result to see details like recording date, document type, and page count. You can view the actual deed image for free. If you need a certified copy, you must request it from the recorder and pay the certification fee.

Most Orange home sales involve grant deeds. These transfer ownership from seller to buyer with implied promises that the seller has not sold the property to anyone else and that there are no hidden liens beyond those listed in the deed. Quitclaim deeds are also common for transfers between family members or to fix title defects.

The database covers Orange and all other cities in the county. When you search, make sure to check the property address or legal description to confirm you have the right parcel. Property owners sometimes have the same name so location details help you find the correct deed.

Cost to Record Deeds

Orange County charges $87 for the first page of a deed. This includes the $12 base fee and $75 SB2 housing fee. Each additional page costs $3. A typical two-page deed costs $90 total. These fees apply whether you live in Orange, Anaheim, or any other city in the county.

Copy fees are lower than in some counties. Plain copies cost $1 per page. Certification adds $1. So a certified copy of a three-page deed costs $6 total. You need certified copies for legal purposes like court filings or mortgage applications.

The county accepts payment by cash, check, or credit card. There is no extra fee for credit card payments which is different from some counties that charge 2% or more. If you use eRecording through a vendor, the vendor may add service fees on top of the county recording fee.

Check the Orange County Recorder website for the current fee schedule and any updates. The county board can change fees with proper notice but they must stay within the limits set by California law.

Documentary Transfer Tax

Orange has no city transfer tax. You pay only the county documentary transfer tax at 55 cents per $500 of the sale price. For a $700,000 home, the tax is $770. This is one of the lowest rates in Southern California.

The seller typically pays this tax at closing but parties can negotiate who pays. The tax applies only to the actual money that changes hands. If a buyer assumes an existing mortgage, that loan amount does not count toward the taxable consideration.

Transfer tax is not the same as property tax. Property tax is an annual charge based on assessed value. Transfer tax is a one-time fee charged only when ownership changes. The county collects transfer tax along with recording fees when you file a deed.

Some Orange County cities charge additional city transfer taxes but Orange does not. This keeps transaction costs down compared to cities with extra layers of transfer taxes.

California Property Records

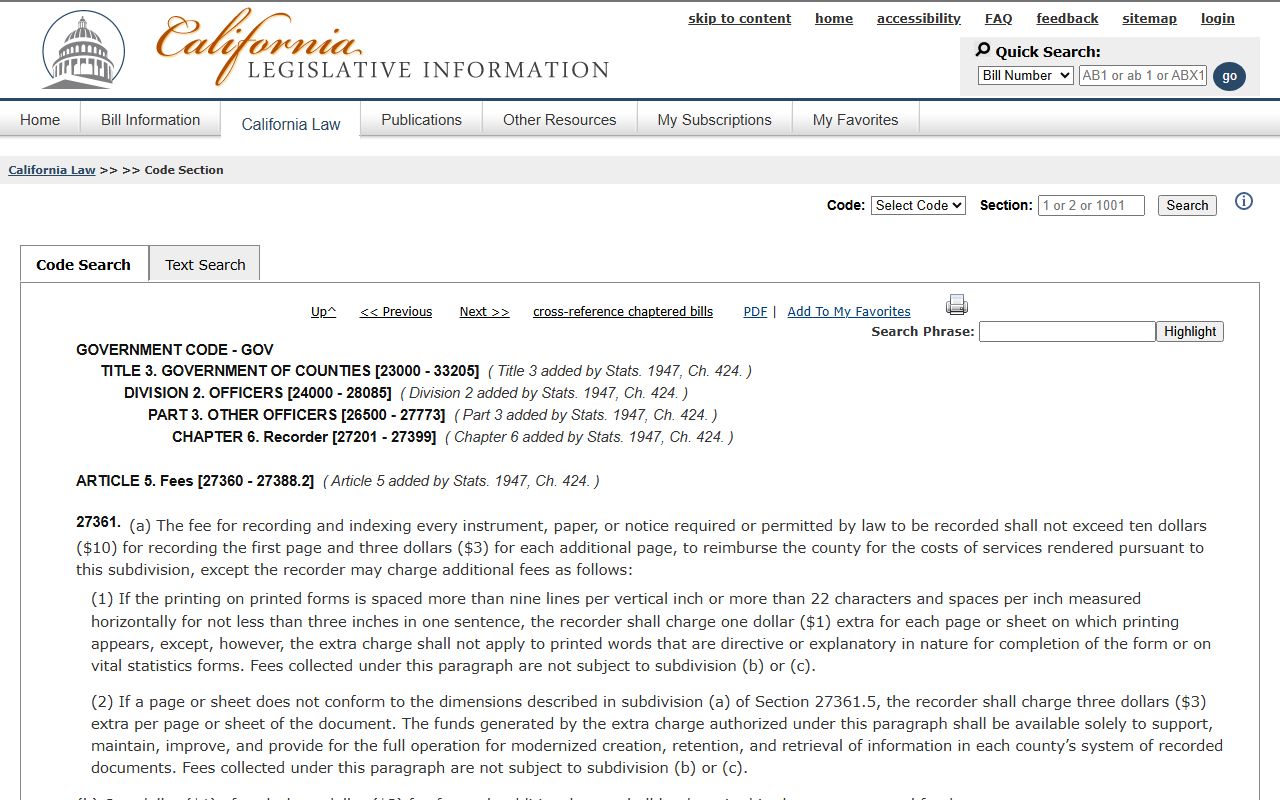

California requires county recorders to accept and record all property documents that meet state standards for format and content. The California Government Code Section 27361 sets maximum recording fees that counties can charge.

This law caps the base recording fee at $10 for the first page and $3 for each additional page. Counties can add certain mandatory fees like the SB2 housing fee and fraud prevention fee but the base amount stays within these limits.

Other Orange County Cities

Orange County has 34 cities total. All use the Orange County Recorder in Santa Ana. Below are other major cities near Orange:

All these cities record property documents at the same county office. Transfer taxes are the same across the county since no Orange County city has adopted additional city transfer taxes.