Siskiyou County Deed Records

Siskiyou County deed records are maintained at the County Clerk Recorder office in Yreka. Anyone can search these records because property ownership is public information under California law. The county keeps deed records going back to the 1850s when California became a state. Most recent documents can be searched online through the RecorderWorks system. Older records require an in-person visit to the office. You will find grant deeds, quitclaim deeds, deeds of trust, reconveyances, and other land documents in the county files. Searching the online index is free but viewing full deed images costs money. The county charges per page for document copies with certified copies costing more than plain copies. You can call the office at 530-842-8065 with questions about recording procedures or fees.

Siskiyou County Quick Facts

Clerk Recorder Office

The Siskiyou County Clerk Recorder handles all property document recordings for the county. Call 530-842-8065 if you have questions about recording fees or procedures. The office is in Yreka at the county courthouse. Office hours are Monday through Friday during normal business hours.

When you record a deed in Siskiyou County, it becomes a permanent public record. Staff examine each document to verify it meets California formatting standards. Documents must have proper margins and space for the recorder stamp. The APN must appear on the first page. Signatures must be notarized. If your deed does not meet these requirements, the office will reject it.

This office records more than deeds. Liens, easements, maps, and other property documents get filed here. Business name statements and marriage licenses also go through this department. For real estate transactions, this is the only place in Siskiyou County where you can officially record a deed. Once recorded, your document becomes part of the permanent public record.

Counter staff can help you locate documents or order copies. They cannot provide legal advice about your transaction. If you need someone to explain what type of deed to use or how to fill out forms, consult a lawyer or title company. County employees are only allowed to tell you about fees and recording procedures under state law.

Search Deed Records Online

Siskiyou County uses RecorderWorks for its online recording database. You can search for deeds at no charge. The system lets you search by grantor name, grantee name, document number, or legal description. Most people search by the names of the buyer or seller.

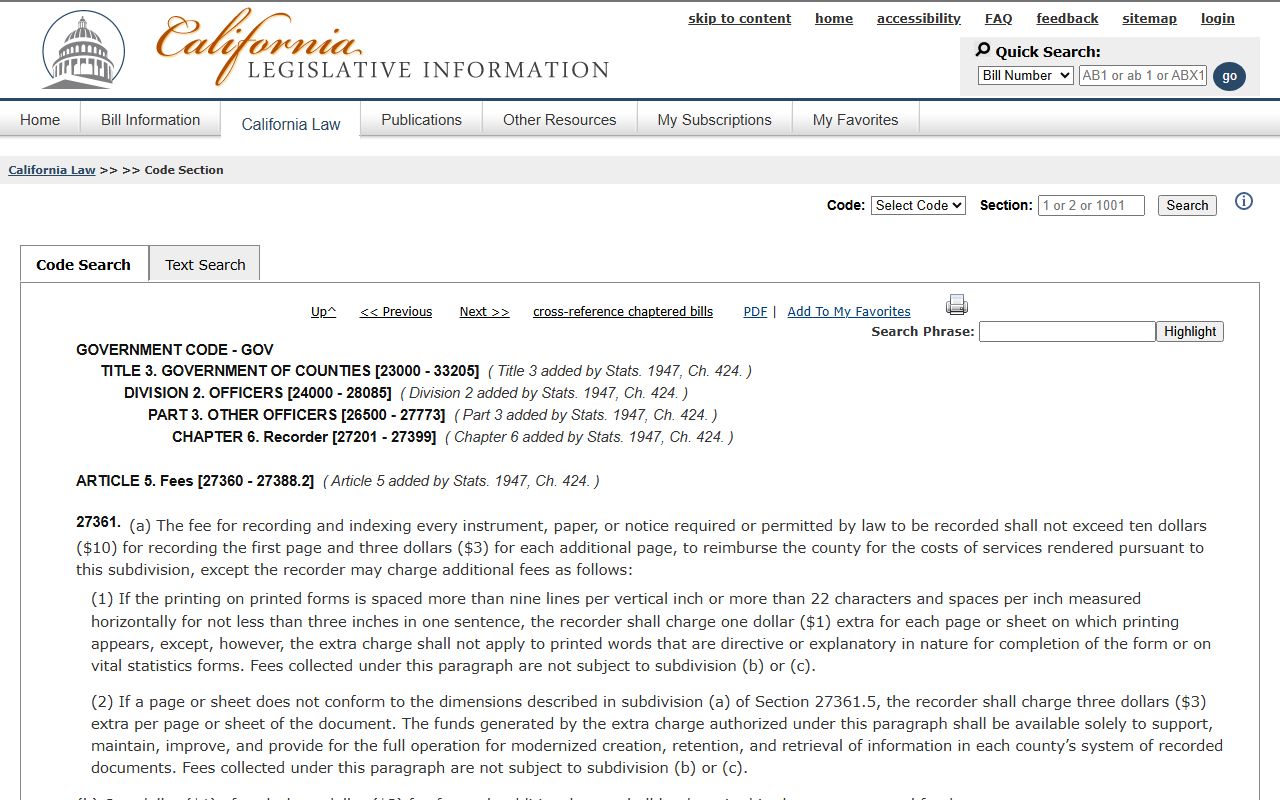

For detailed information about California recording fee statutes, visit Government Code Section 27361 which sets the maximum fees county recorders can charge for recording documents including the base fee and per-page charges.

The grantor is the person selling or giving property. The grantee is the buyer or recipient. Type in the last name first, then the first name. The system shows all matching documents with basic information like recording date and document type.

Searching is free but viewing full documents costs money. You pay per page when you want to see the actual deed image. After you pay, you can download a PDF of the document. If you need a certified copy with the county seal, that costs more and gets mailed to you.

Very old deeds might not be in the online system. If you are researching historical property ownership, you may need to visit the office in Yreka. Bring the property address or APN if you know it. Staff can retrieve archived files from storage. Some historical records are only on paper or microfiche.

How to Record a Deed

Every deed recorded in Siskiyou County must follow California formatting rules. One-inch margins on all sides. A blank space at the top right of page one for the recorder stamp. The document must include the APN which is the assessor parcel number from your property tax bill.

California law requires all real estate transfers to be in writing under Civil Code Section 1091. The person transferring the property must sign the deed in front of a notary public. The notary verifies their identity and witnesses the signature. Without proper notarization, the county will not accept your deed for recording.

Documentary transfer tax applies to most deed recordings. The county charges 55 cents per $500 of the purchase price or consideration. On a $150,000 property sale, the transfer tax is $165. Certain transactions are exempt such as gifts between family members or transfers due to death. The deed must state the tax amount or claim a valid exemption.

Include a Preliminary Change of Ownership Report when you record a deed. This form gives the assessor information needed to update property tax records. If you forget this form, you could face a $20 penalty. The county needs this data to ensure property taxes are billed to the correct owner.

Recording protects your ownership rights under California's race-notice system found in Civil Code Sections 1213-1214. The first person to record a deed generally has priority in disputes over the same property. Waiting to record can create legal problems if someone else files a competing claim.

Recording Fees

Siskiyou County charges California standard recording fees set by state law. Government Code Section 27361 allows up to $10 for the first page and $3 for each additional page. On top of this base amount are mandatory state fees including the fraud prevention fee and SB2 housing fee.

The SB2 fee is $75 for most property sales under the Building Homes and Jobs Act. This money funds affordable housing projects statewide. The maximum SB2 fee is $225 even on expensive properties. Some transactions are exempt from SB2 such as transfers between spouses or from parents to children. Check with your title company about exemptions.

Copy fees depend on the type you need. Plain copies cost less and work for general research. Certified copies include the county seal and a signed certificate stating the copy is accurate. Most legal matters require certified copies. The certification process takes extra time and costs more money.

If you mail your deed for recording, include the full fee and a stamped return envelope. Processing times vary depending on workload. In-person submissions usually get recorded faster, often the same day if you arrive early. Electronic recording through certified vendors is available in many California counties and processes documents within hours.

Types of Deeds

Grant deeds are most common in Siskiyou County real estate sales. When you buy property, the seller gives you a grant deed transferring ownership. Under California Civil Code Section 1113, grant deeds include implied promises that the seller owns the property and has not conveyed it to anyone else.

Quitclaim deeds make no warranties about ownership. The person signing just releases whatever interest they might have. Divorcing couples use quitclaims when one spouse transfers their share to the other. Parents might quitclaim property to children. These deeds also fix title problems like when your name is spelled incorrectly on an old document.

Deeds of trust are loan documents, not ownership transfers. When you get a mortgage, you sign a deed of trust giving the lender a security interest in your home. If you stop paying, they can foreclose. When you pay off the loan, the lender records a reconveyance deed releasing their claim. Both documents appear in the public index along with regular deeds.

Other recorded documents include liens, easements, and covenants. Tax liens from government agencies. Mechanic liens from contractors who were not paid. Utility easements giving companies access to your property. HOA restrictions on what you can do with your land. All of these affect property ownership and appear in title searches.

California Recording Laws

County recorders have specific duties under California law. Government Code Section 27201 requires them to accept any document that meets statutory requirements and for which proper fees are paid. They cannot refuse to record a deed just because they think it is unwise. Their role is to file documents, not judge the merits of transactions.

Recording creates a public record that anyone can search. This transparency helps prevent fraud and allows buyers to research property history before purchasing. Title companies rely on these records to issue title insurance. Lenders check them before approving mortgages. The public nature of deed records is a cornerstone of the American property system.

Notarization is required for all deeds under California law. A notary public verifies the identity of the person signing and confirms they are signing voluntarily. This helps prevent fraud and forgery. The notary adds their seal and signature to the deed. Without proper notarization, the county recorder will reject your document.

Electronic Recording

Siskiyou County accepts electronic recording through vendors certified by the California Attorney General. The state maintains a list of approved eRecording systems under the Electronic Recording Delivery Act. Most eRecording is done by title companies and law firms with business accounts.

Electronic recording is faster than paper filing. Documents usually process within hours instead of days. The system works nights and weekends. Even though the office is closed, your deed gets a timestamp showing when it was submitted. Staff review and officially record it on the next business day.

Individual homeowners typically cannot use eRecording directly. If you are recording your own deed, you probably need to file it on paper by mail or in person. Check with your title company to see if they can handle the eRecording for you. This ensures your deed is formatted correctly and recorded quickly.

Adjacent Counties

If your property is not in Siskiyou County, check these neighboring counties: