Tehama County Deed Records

Tehama County deed records are maintained at the Recorder-Clerk office in Red Bluff. All property ownership documents for the county's 2,951 square miles get filed here. With about 65,000 residents in Red Bluff, Corning, and rural areas, Tehama County sees regular real estate activity involving farmland, ranches, residential properties, and timberland. The recorder offers online deed searches for recent records with electronic recording services coming soon. Most deeds here involve agricultural land sales, residential properties in Red Bluff and Corning, and rural parcels along the Sacramento River. Contact the recorder at (530) 527-3350 or visit 444 Oak Street in Red Bluff to search records or file new documents.

Tehama County Quick Facts

Tehama County Recorder

The Tehama County Recorder-Clerk office sits at 444 Oak Street in Red Bluff. Call (530) 527-3350 for information. Office hours are Monday through Friday 8am to 5pm. This office handles all deed recordings for Tehama County.

When you file a deed, staff review it for proper formatting. The document must be typed, notarized, and include a complete legal description. If something is wrong, they reject it and tell you what to fix. Once accepted, they stamp it with the recording date and time.

Tehama County follows California recording statutes. Under Government Code Section 27201, the recorder must accept any instrument authorized by law as long as you pay the fees and it meets formatting requirements.

The recorder maintains a public index of all documents. Anyone can search this index to find property ownership or liens. Tehama County offers online deed searches.

Search Deed Records

Tehama County offers online deed searches through their website. You can look up documents by name or document number. The system shows recording dates, document types, and parties involved. Full document images may be available for viewing.

To search by grantor or grantee, enter the last name. The system returns matching results. Click on one to see details. There may be a fee to view or print full deed images. Check with the office for current pricing.

Certified copies come from the recorder office. Request them online, by mail, or in person. Certification adds the official county seal and recorder's signature confirming the copy is accurate. These are required for legal purposes like refinancing or court proceedings.

Electronic recording is coming soon to Tehama County but is not yet available. For now, file deeds in person or by mail. Bring the original signed and notarized deed plus payment for recording fees.

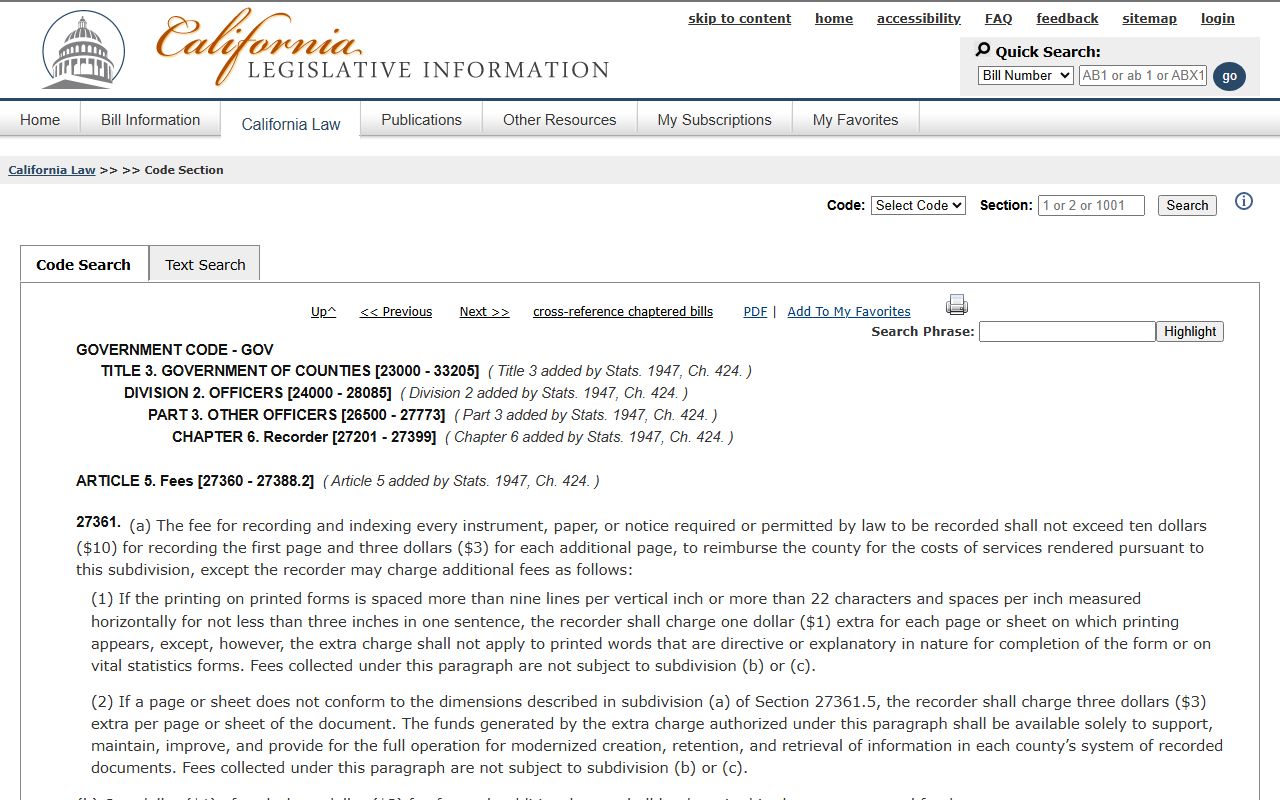

Recording Fees

Recording a deed in Tehama County costs around $14 to $20 for the first page. Each additional page costs $3. The exact fee depends on local add-ons to the state base fee set by Government Code Section 27361.

Documentary transfer tax is 55 cents per $500 of the purchase price. On a $280,000 farm sale, the transfer tax is $308. This applies to most property sales. Gifts and certain family transfers may be exempt from transfer tax.

Copy fees are a few dollars per page for plain copies. Certified copies cost around $6 for the first page and $3 for each additional page. Certification includes the county seal and recorder's signature.

Payment methods include cash and checks. If mailing a deed, send a check payable to Tehama County and a self-addressed stamped envelope for return of the recorded copy.

Types of Deeds

Grant deeds are standard for property sales in Tehama County. Using "grant" creates implied warranties under California law. The seller promises they have not sold the property to anyone else and that no hidden liens exist except those disclosed.

Quitclaim deeds transfer property without warranties. The grantor just releases any claim they have. These work for family transfers or clearing title defects. A quitclaim makes no promises about title quality.

Deeds of trust secure agricultural loans and home mortgages in Tehama County. When you borrow to buy property, you sign a deed of trust. This gives the lender a security interest. If you default, they can foreclose. When paid off, they file a reconveyance deed.

Tax liens can attach to Tehama County property when owners owe back taxes. Federal, state, and local governments can record tax liens. These show up in the public index and affect property title until paid.

Learn about grant deed warranties at California Civil Code Section 1113 which explains the implied covenants in a grant deed.

How to Record

To record a deed in Tehama County, prepare a proper document on standard paper. Include the legal description, names of all parties, and consideration amount for sales. Leave margins for the recorder's stamp.

Get the deed notarized. Most deeds require notarization. The notary verifies your identity and witnesses your signature. California notaries are commissioned by the Secretary of State for four-year terms.

Submit the deed to Tehama County Recorder, 444 Oak Street, Red Bluff, CA 96080. Include payment. If mailing, add a self-addressed stamped envelope. The recorder will process it and return a recorded copy.

Recording gives you priority. California uses a race-notice system. The first to record generally has priority over later buyers, as long as they had no notice of earlier unrecorded transfers.

Recording Law

All Tehama County deeds must comply with California statutes. Real property can only be transferred by written instrument signed by the grantor. This comes from California Civil Code Section 1091. Oral agreements to transfer land are not valid.

Recording provides constructive notice. Once your deed is in the Tehama County index, everyone is legally considered to know about it. They cannot claim ignorance later. This transparency helps prevent fraud.

Nearby Counties

If your property is not in Tehama County, check these neighboring recorders: