Ventura County Property Deeds

Deed records for Ventura County are managed by the Clerk-Recorder office located in Ventura. This office has handled deed filings since the county was formed in 1873. When you buy or sell property anywhere in Ventura County, your deed gets recorded here. The office maintains an online database where you can search for recorded documents. Most people use it to check ownership history or pull copies of old deeds. The database includes various document types like grant deeds, quitclaim deeds, deeds of trust, and reconveyances. Anyone can access these records because property ownership is public information in California. The system is free to search but charges fees for copies.

Ventura County Quick Facts

Clerk Recorder Office

The Ventura County Clerk-Recorder processes all real property documents for the entire county. You can reach them at (805) 654-3665 or email clerk.recorder@ventura.org if you have questions about recording documents or ordering copies. Staff can tell you about fees and what forms you need.

This office does not just handle deeds. They also record liens, easements, notices of default, and other land-related documents. Marriage licenses and fictitious business name statements go through this office too. When it comes to deeds, they accept documents Monday through Friday during business hours. Most deeds get recorded the same day if you submit them early enough in the day.

Recording a deed creates a public record. Once the clerk stamps your document with a date and assigns it a number, anyone can look it up. The county maintains these records forever. You can find deeds from decades ago if you know where to look. Older records might be on microfiche or paper instead of digital files.

If you need help with a deed, the recorder staff cannot give legal advice. They will tell you what documents they received and when they were recorded. They can make copies for you. But if you need someone to explain what a deed means or how to fill one out, hire a lawyer or title company. County workers are not allowed to provide that kind of help.

Online Records Search

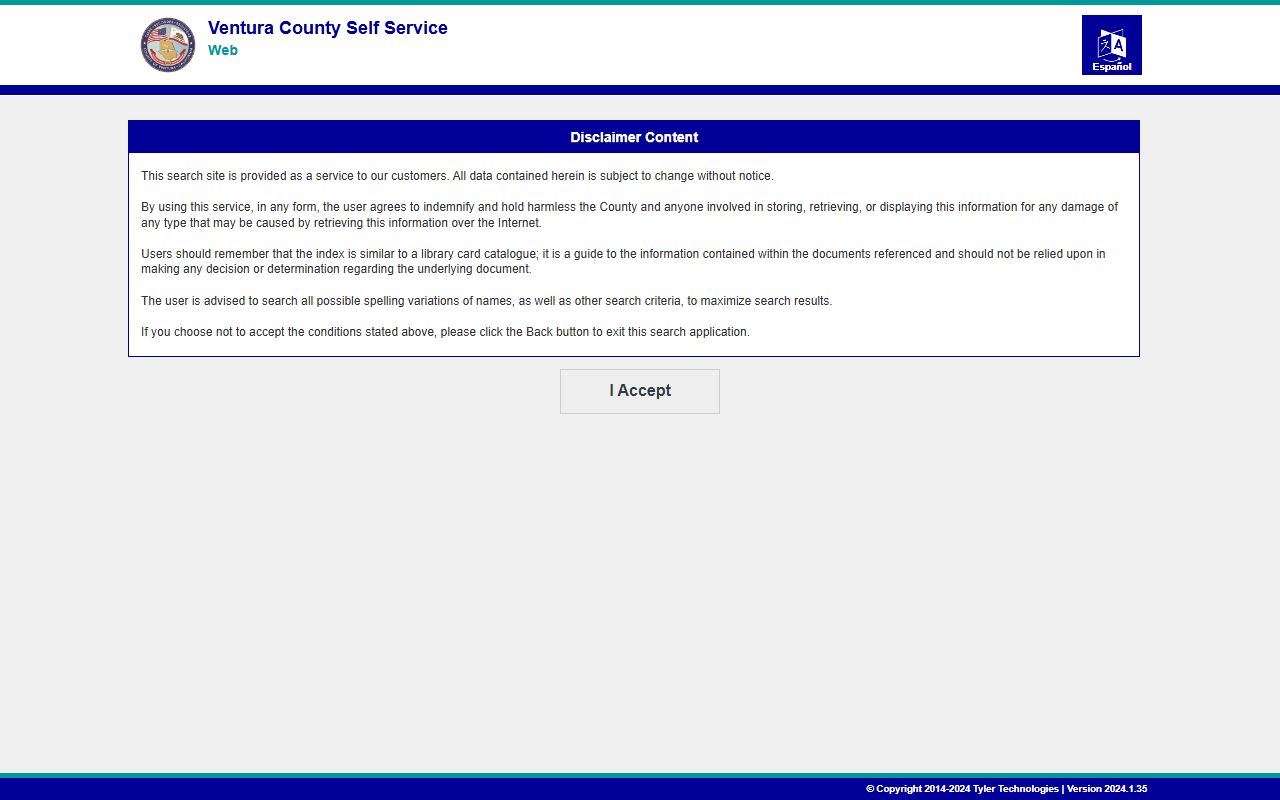

Ventura County offers free online access to its deed database. The self-service portal lets you search by name, document number, or legal description. Most people search by the grantor or grantee name to find all documents involving a specific person or company.

To access the Ventura County online recording database, visit the self-service portal where you can search for property documents, view deed images, and order certified copies without needing to visit the office in person.

The search is free but viewing full documents costs money. You pay per page when you want to see the actual deed image. Certified copies cost more than plain copies. The system takes credit cards. After you pay, you can download the document or have them mail you a certified copy with the county seal.

If the property changed hands a long time ago, it might not show up in the online database. Older records exist but you have to visit the office to see them. Bring the address or APN if you have it. Staff can pull files from the vault. Some very old deeds are only on paper or microfiche.

How to Record a Deed

Any deed you record in Ventura County must meet California formatting rules. The document needs a one-inch margin on all sides. The first page must have a blank space in the top right corner for the recorder stamp. If your deed does not meet these specs, the office will reject it and send it back.

All deeds must include the APN for the property. This is the assessor parcel number. You can find it on your property tax bill. The deed also needs a legal description. This is the official survey description of the property boundaries. Most deeds copy this from the previous deed in the chain of title.

Under California Civil Code Section 1091, any transfer of real estate must be in writing. An oral promise to give someone property has no legal effect. The deed must be signed by the person transferring the property. That signature must be notarized. Without a notary seal, the county will not record it.

Documentary transfer tax applies to most deeds in Ventura County. The rate is 55 cents for every $500 of the purchase price. If you sell a house for $500,000, the transfer tax is $550. This tax gets paid when you record the deed. Some transactions are exempt, like gifts between family members or transfers due to divorce.

When you submit a deed for recording, include the Preliminary Change of Ownership Report. If you do not include this form, you might face a penalty. The assessor needs this information to update property tax records. There is a $20 fee if you file the report late without the deed.

Recording Costs

Ventura County charges standard California recording fees. The base fee covers the first page of your deed. Each additional page costs $3. There is also a fraud prevention fee and the SB2 affordable housing fee on most transactions.

The SB2 fee is $75 for most property transfers. This fee was created by the Building Homes and Jobs Act. It funds affordable housing projects across California. The maximum SB2 fee is $225 even for very expensive properties. Certain transactions are exempt from SB2, like transfers between family members.

Copy fees are separate from recording fees. A plain copy of a deed costs a few dollars per page. If you need a certified copy with the county seal, that costs more. Certification adds an official stamp and signature from the county clerk. Courts and banks usually require certified copies for legal matters.

Mail requests take longer than in-person visits. If you mail a deed for recording, include the fee and a self-addressed stamped envelope. Processing time can be several weeks depending on how busy the office is. In-person submissions usually get recorded the same day.

Common Deed Types

Grant deeds are the most common type in Ventura County. When someone sells you a house, they give you a grant deed. This type of deed includes implied promises that the seller actually owns the property and has not sold it to anyone else. These promises are built into California law under Civil Code Section 1113.

Quitclaim deeds make no promises at all. The person signing just gives up whatever interest they might have in the property. These deeds are common in divorces or when clearing up title problems. If your name was spelled wrong on an old deed, you might sign a quitclaim to yourself with the correct spelling.

Deeds of trust are not ownership deeds. They are loan documents. When you get a mortgage, you sign a deed of trust giving the lender a claim on your house. If you stop paying, they can foreclose. When you pay off the loan, the lender files a reconveyance deed releasing their interest. These documents all go in the same public index as regular deeds.

State Recording Laws

California has a race-notice recording system. Under Civil Code Sections 1213-1214, the first person to record a deed wins if there is a dispute. This means recording is critical. If someone sells the same property to two different buyers, whoever records their deed first usually gets the property.

Recording fees are set by state law. Government Code Section 27361 says the fee cannot exceed $10 for the first page and $3 for additional pages. Counties can add certain mandatory fees on top of this base amount. That is why the total recording fee is higher than $10.

County recorders have specific duties under California law. Government Code Section 27201 requires them to accept any document that meets statutory requirements and for which proper fees are paid. They cannot refuse to record a deed just because they think it is a bad deal. Their job is to file what you give them, not to judge whether it makes sense.

Cities in Ventura County

All property deeds for cities in Ventura County are recorded at the county clerk-recorder office. No city maintains its own deed records. Below is the major city in Ventura County with a population over 100,000:

Note: The city of Ventura may charge its own documentary transfer tax in addition to the county tax.

Adjacent Counties

If your property is not in Ventura County, check these neighboring counties: