Search Thousand Oaks Deeds

Thousand Oaks property deeds are recorded with Ventura County Recorder. The city does not have its own recording office. All real estate documents for Thousand Oaks go through the county system located in the county seat. Ventura County maintains deed records for ten cities including Thousand Oaks, Simi Valley, Oxnard, and Ventura. You can search these records online using the county's self-service portal or request copies by mail or in person. Thousand Oaks is in the southeast part of Ventura County near the Los Angeles County border. It has about 127,000 people living across 55 square miles. The city sits in the Conejo Valley and is known for residential neighborhoods, parks, and open space.

Thousand Oaks Quick Facts

Ventura County Deed Recording

Ventura County Clerk and Recorder handles all deed filings for Thousand Oaks. You can reach them at (805) 654-3665 or email clerk.recorder@ventura.org. The recorder office is in Ventura which is about 35 miles west of Thousand Oaks along the coast. Most people do not need to visit in person because the county offers online searches and eRecording.

When you buy property in Thousand Oaks, your title company or attorney will record the deed electronically. The county processes eRecorded documents faster than paper. Most electronic submissions get recorded the same day or next business day depending on when they arrive.

Recording a deed creates a public record that protects your ownership. Anyone can search for recorded deeds using names, addresses, or document numbers. This public access helps prevent fraud and allows buyers to check for liens or other claims before purchasing property.

For comprehensive information about Ventura County recording, visit the Ventura County deed records page which includes details about fees, online search options, eRecording vendors, office locations, and how to request certified copies of deeds for properties in Thousand Oaks and throughout Ventura County.

Online Deed Search

Ventura County offers free online access to recorded documents through its self-service portal. Go to the Ventura County online records system to search for Thousand Oaks deeds. You can search by name, document number, or property details.

To search by owner name, enter the last name first. The system shows all matches with basic information like recording date and document type. Click a result to see the full deed image on your screen. Viewing documents online is free. If you need a certified copy for legal use, you must request it from the recorder and pay the certification fee.

Most Thousand Oaks home sales use grant deeds. A grant deed transfers property from seller to buyer with implied warranties that the seller owns the property and has not sold it to anyone else. Quitclaim deeds are used for transfers between family members or to clear up title problems. These give no warranties about ownership.

The database covers all of Ventura County. When you search, you may see deeds from other cities if the person owns multiple properties. Check the address or legal description to make sure you have the right property in Thousand Oaks.

Recording Fees in Thousand Oaks

Ventura County charges standard recording fees that apply to Thousand Oaks and all other county cities. The first page of a deed costs about $89 to record. This includes base fees and mandatory state surcharges like the SB2 housing fee. Each additional page costs $3.

Copy fees vary by format. Plain copies cost less than certified copies. Certification adds the county seal and a signed statement from the recorder. You need certified copies for court filings, mortgage applications, or any legal purpose. Plain copies work fine for personal records.

The SB2 fee is $75 per transaction for most deeds. This state-mandated fee funds affordable housing programs throughout California. Every county collects it. The maximum SB2 fee is $225 for transactions involving three or more parcels.

If you use electronic recording, your vendor may charge service fees on top of county recording fees. Most title companies include these costs in their closing fees. Ask for a detailed breakdown of all recording costs before you close on a Thousand Oaks property.

Thousand Oaks Transfer Tax

Thousand Oaks does not have a city transfer tax. You pay only the county documentary transfer tax of 55 cents per $500 of the sale price. For a $900,000 home, the transfer tax is $990. This is lower than many Southern California cities that add their own city taxes on top of the county rate.

The seller typically pays transfer tax at closing unless the parties agree otherwise. The tax is based on the net purchase price. If a buyer assumes an existing mortgage, that loan amount does not count toward the taxable consideration.

Transfer tax and property tax are different. Property tax is an ongoing annual tax based on assessed value. Transfer tax is a one-time fee charged only when property ownership changes. Some transfers like gifts between spouses or inheritances may be exempt from transfer tax.

Your title company calculates the transfer tax and includes it on your settlement statement along with all other closing costs. The county collects the tax when the deed is recorded and stamps the amount on the recorded document.

California Transfer Tax Law

California law allows counties to charge a documentary transfer tax on property sales. The California Revenue and Taxation Code Section 11911 sets the state rate at 55 cents per $500 of consideration.

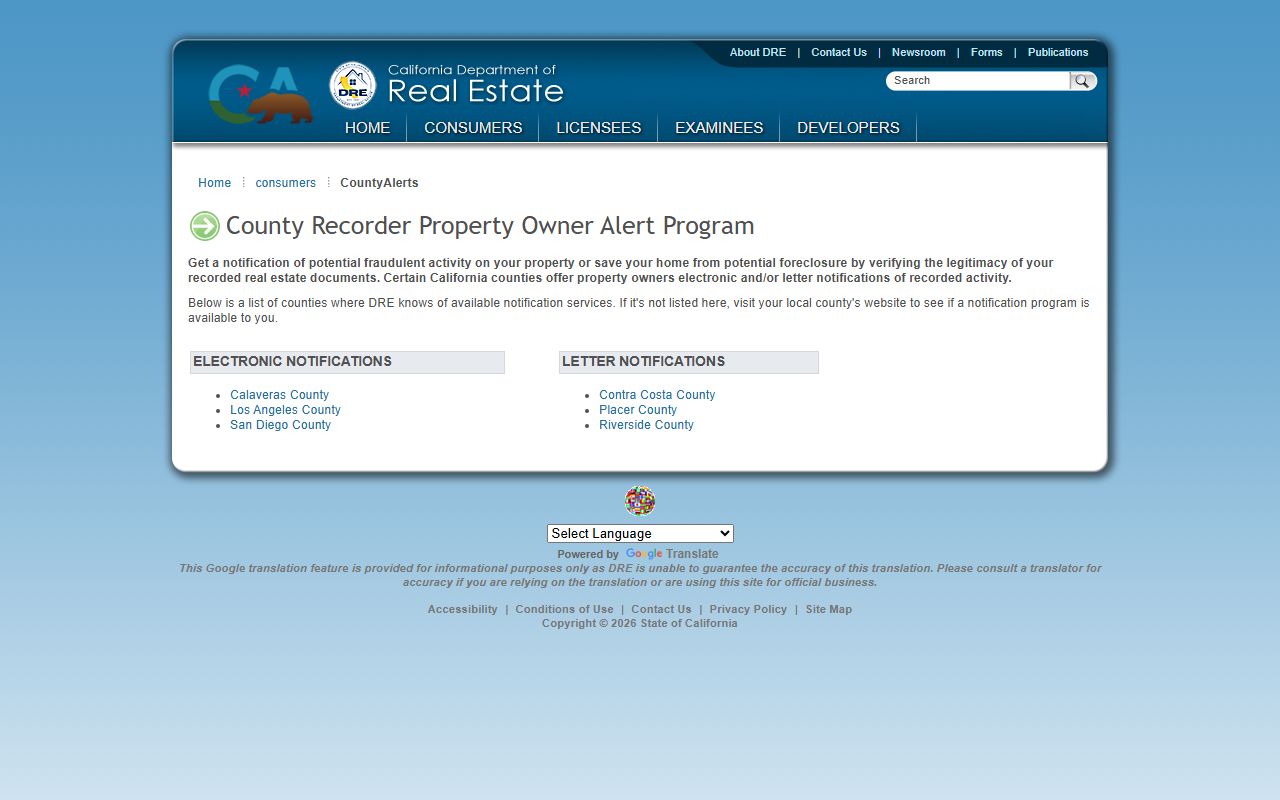

Some counties offer fraud alert programs that notify property owners when documents affecting their property get recorded. This helps catch fraudulent deeds and forged documents before they cause serious problems. Check with Ventura County to see if they offer this service for Thousand Oaks properties.

Other Ventura County Cities

Ventura County has ten incorporated cities. All use the county recorder in Ventura. Below are other major cities near Thousand Oaks:

All these cities record deeds at the same county office. Recording fees and transfer tax rates are uniform across Ventura County since no city has adopted additional transfer taxes.