Riverside Deed Records Search

Riverside County deed records are available through the Assessor-County Clerk-Recorder office, which maintains property ownership documents for one of the fastest growing counties in California. You can search these records online or request copies by mail. The office serves over 2.4 million residents across 28 cities and large unincorporated areas. Online searches use the web self-service portal to look up deeds by name or document number. The county also offers a helpful fee calculator tool so you can estimate recording costs before you submit documents. Mail processing takes one to two weeks while online requests are typically done within 48 hours, making the web portal a much faster option for most people.

Riverside County Quick Facts

County Recorder Office

The Riverside County Assessor-County Clerk-Recorder handles all property deed recordings. You can contact them at (951) 486-7000 or toll-free at (800) 696-9144. Staff answer questions about fees, document requirements, and how to order copies. They do not provide legal advice about which type of deed to use or how to complete forms.

To learn about recording services and access online tools, visit the main recorder page where you can find information about document submission, fee schedules, and links to the self-service portal for Riverside County deed searches.

Mail submissions are accepted but take longer than other methods. The office states that mail processing takes one to two weeks from when they receive your documents. Online processing through the web portal is much faster at about 48 hours. Electronic recording through certified vendors is fastest of all and most professional users choose this option.

When you pay by credit card, the county charges a 2.15% convenience fee on top of the recording fees. Cash and checks do not have this extra charge. For a $100 recording, the credit card fee would be $2.15. This adds up on high-value recordings where the SB2 fee reaches the $225 maximum.

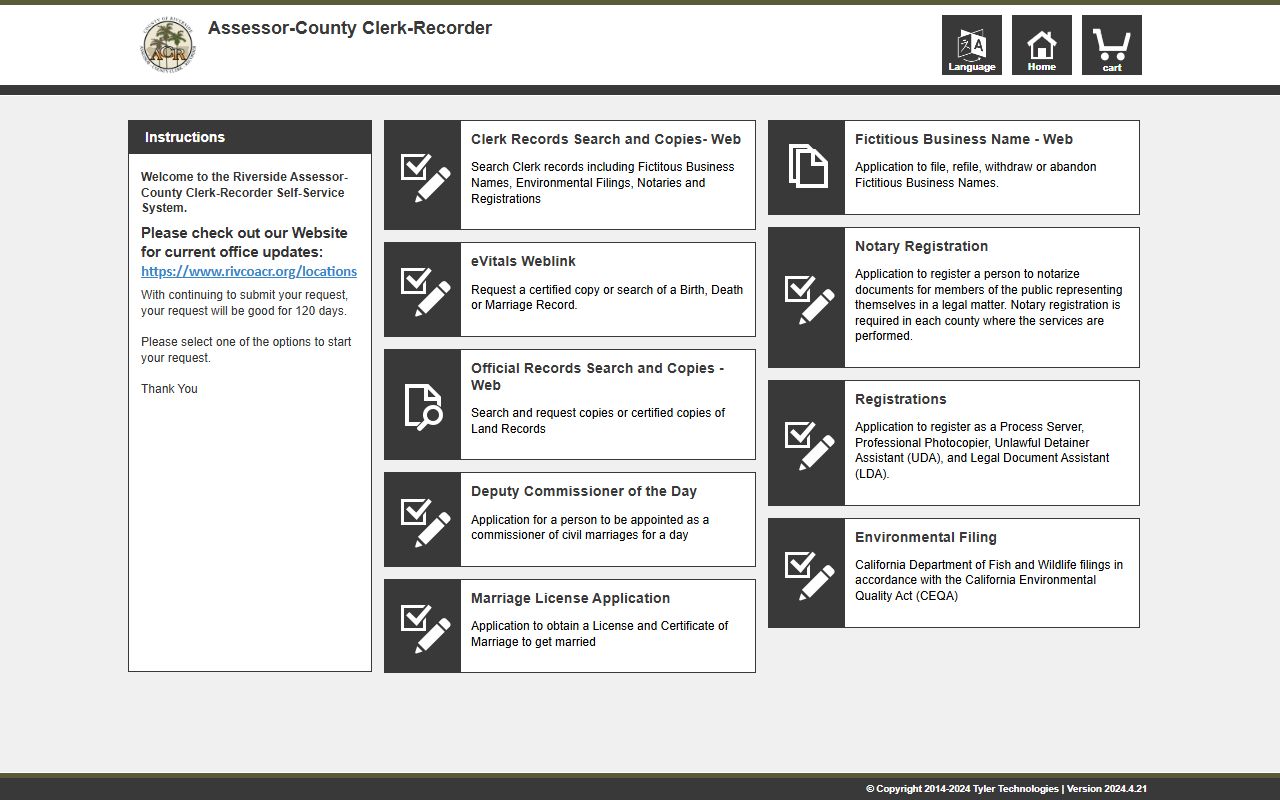

Online Deed Search

Riverside County provides a web self-service portal for searching deed records. You can look up documents by name, date, or document number. The system is free to use for basic searches. It shows you an index of matching records with details like recording date and document type.

Access the online search system at the web self-service portal to look up Riverside County property records using grantor or grantee names, document numbers, or other search criteria with the ability to view and purchase document copies online.

Viewing or printing full documents may require payment. The system accepts credit cards for document purchases. You can buy single copies or multiple pages depending on what you need. Download the files after payment or have them mailed to you if you prefer paper copies.

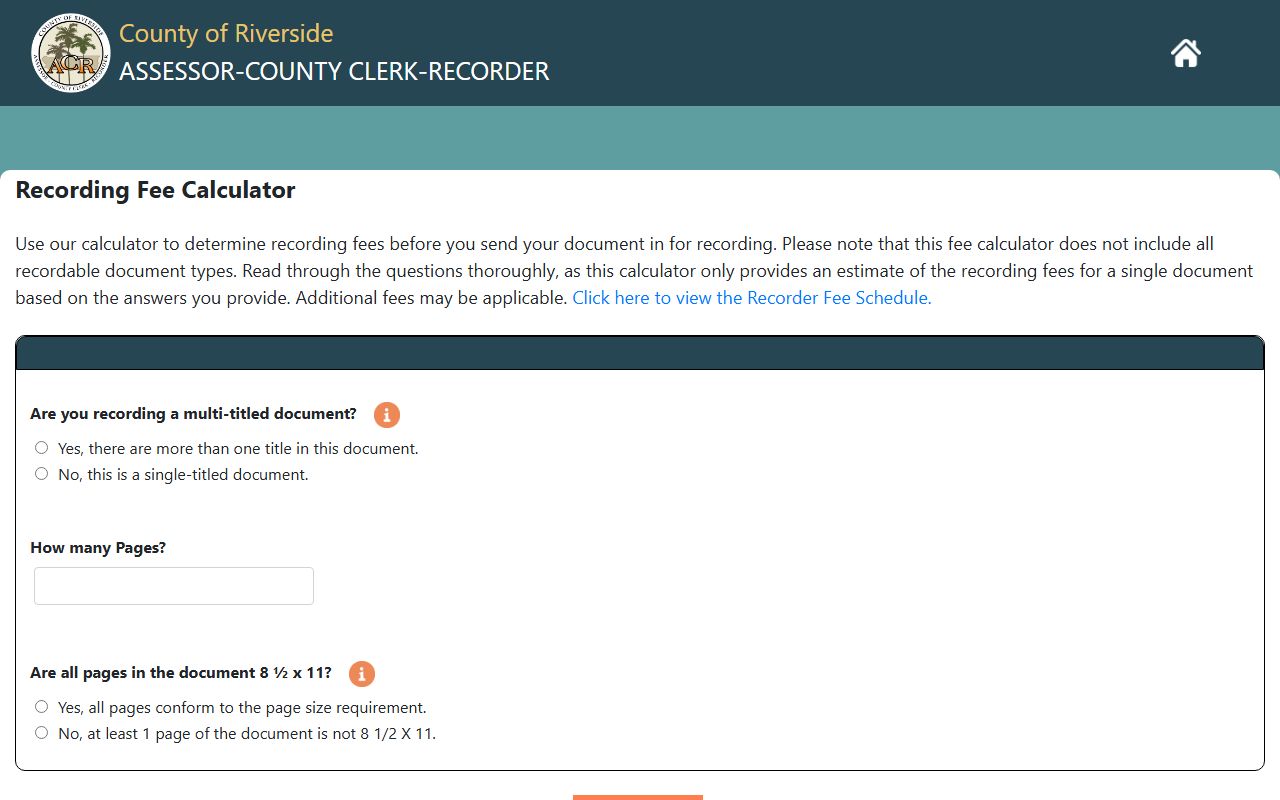

The county also offers a helpful fee calculator tool. Before you record a deed, use the calculator to estimate your total cost. You enter the document type, number of pages, and property value. It calculates the base fee, SB2 fee, transfer tax, and any other charges. This helps you budget for the recording costs.

If you plan to record documents yourself, use the fee calculator to estimate recording costs before submitting your deed by entering document details like page count and property value to get a breakdown of all applicable fees including base fees, SB2 charges, and documentary transfer tax.

Electronic recording is available through certified vendors. Most title companies and law offices use this service. You upload your documents to the vendor's system. They submit them to the county electronically. Recording happens within hours instead of days or weeks. You receive a confirmation email with the document number and recording date.

Fees and Recording Costs

Copy fees in Riverside County are $8 for the first page and $1 for each additional page. Certification adds $2 to the total. A certified copy of a four-page deed would cost $8 + $3 + $2 = $13. Plain copies without certification cost less if you do not need the county seal and signature.

Recording fees follow California state law. The base fee applies to the first page. Additional pages are $3 each. The SB2 affordable housing fee is $75 for most residential property transfers. Documentary transfer tax is 55 cents per $500 of the purchase price. Some cities in Riverside County have their own city transfer tax on top of the county rate. The city of Riverside charges $1.10 per $500, which is double the standard rate.

Total recording costs vary based on your document. A typical two-page grant deed might cost around $90 to $100 when you add up the base fee, SB2 fee, per-page charges, and any applicable transfer taxes. Use the online fee calculator to get an exact estimate before submitting your deed.

Common Deed Types

Grant deeds are what most buyers receive when they purchase property. The seller grants the property to the buyer. California law implies certain warranties with this deed type. The seller promises they own the property and have not conveyed it to anyone else. The deed also promises there are no undisclosed liens except those mentioned in the deed or in public records.

Quitclaim deeds convey only the interest the grantor has, with no promises about what that interest is. They are useful for clearing title issues or transferring property between family members. If you go through a divorce and need to remove your ex from the title, a quitclaim deed is often used. You should always get title insurance when accepting a quitclaim deed because you have no warranties about the condition of title.

Trust deeds are not ownership documents. They are security instruments for loans. When you take out a mortgage, you sign a deed of trust that gives the lender a security interest in your home. If you default, the lender can foreclose through the trustee named in the deed. After you pay off the loan, the lender files a full reconveyance deed to release their interest.

Other recorded documents include liens, easements, and restrictions. Mechanic liens from unpaid contractors get recorded here. Tax liens from government agencies. HOA covenants, conditions, and restrictions. Utility easements. All these documents create rights or claims that affect the property. Title companies review all recorded documents before issuing insurance policies.

Cities in Riverside County

Riverside County has 28 cities. All property deeds are recorded at the county level. Below are the largest cities:

Note: The city of Riverside has a double transfer tax rate compared to the standard county rate.

Nearby Counties

If the property is located outside Riverside County, check these neighboring counties: