Sacramento County Deed Records

Sacramento County deed records go back to 1849, making this one of the oldest continuous recording systems in California. The County Clerk-Recorder maintains these files at 3636 American River Drive in Sacramento. You can search deed records online through their document index system or visit the office in person. The database includes property deeds, deeds of trust, liens, easements, and other land documents. Most people search by name or property address to find ownership information. Sacramento serves as California's state capital with over 1.5 million residents across cities like Sacramento, Elk Grove, Folsom, and Citrus Heights. All deed work for properties in these cities and throughout the county flows through the same recorder office.

Sacramento County Quick Facts

Clerk-Recorder Office Details

The Sacramento County Clerk-Recorder operates from their American River Drive location. Phone numbers are (916) 874-6334 or toll-free (800) 313-7133. The office handles all deed recordings for Sacramento County. Business hours are standard weekday hours, and staff can answer questions about recording procedures and fees.

This office combines clerk and recorder functions. The recorder side processes land documents. The clerk side handles marriage licenses, birth certificates, and other vital records. When you need to file a property deed, you want the recorder section. Documents submitted before 3pm usually get recorded the same day, according to their website. Anything after that cutoff records the next business day.

Recording fees in Sacramento County are $20 for the first page. Each additional page costs $3. A five-page deed costs $20 + $12 = $32 in recording fees, not counting transfer tax or other charges that may apply based on the transaction type. The county also charges a fraud prevention fee and SB2 affordable housing fee on certain documents.

To learn more about the Sacramento County recording process and fees, visit the main Clerk-Recorder website where you can find detailed information about document requirements, fee schedules, and office locations for recording property deeds and other official documents.

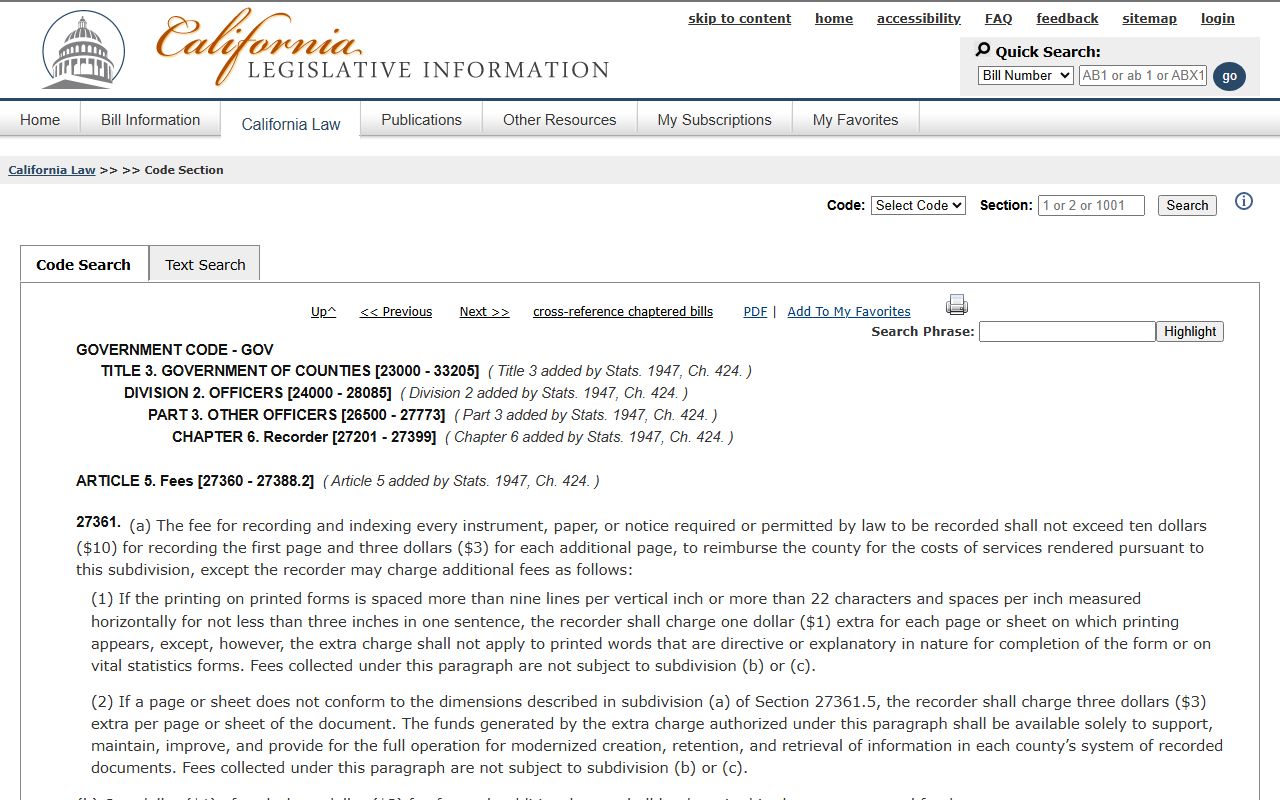

California Government Code sections set the framework for county recording fees statewide. Section 27201 defines county recorder duties, while Section 27361 sets maximum fees counties can charge. Sacramento stays within these limits but adds state-mandated fees passed through legislation in recent years.

Search Records Online

Sacramento County provides free online access to their deed index going back to 1849. You can search at the Recorder's Document Index website, which offers multiple search options including grantor/grantee names, document numbers, and date ranges for finding property records throughout the county's history.

The search system lets you look up deeds by grantor name, grantee name, document number, or date range. Type in a last name to see all matching records. The results show basic details like recording date, document type, and parties involved. Some older records may have limited information available online.

To view actual document images online, you may need to pay a fee or create an account depending on the record type and age. Newer documents are more likely to have full images available. Older records from the 1800s and early 1900s might require an in-person visit to view microfilm or original paper files stored at the office.

If you cannot find what you need online, call the office during business hours. Staff can search their systems and let you know if a document exists. They can also mail certified copies for a fee. Expect to provide as much detail as possible such as property address, APN, or the names of people involved in the transaction.

Property Document Types

Grant deeds are the most common form of property transfer in California. These deeds include implied warranties under Civil Code Section 1113 that the grantor has not previously conveyed the property and that no undisclosed encumbrances exist. Most home sales use grant deeds.

Quitclaim deeds transfer ownership without any warranties. The grantor simply releases whatever interest they have in the property. These work well for transfers between family members, clearing title clouds, or fixing errors in previous deeds. You might quitclaim property to a trust you created or to correct a misspelled name from an old deed.

Deeds of trust secure mortgage loans against real property. When you borrow money to buy a house, you sign a deed of trust giving the lender a security interest. The trustee holds title until you pay off the loan. After full payment, the lender files a reconveyance deed releasing their claim. Both documents appear in the public record.

Liens also get recorded. Tax liens from government agencies. Mechanic's liens from contractors who did not get paid. Judgment liens from court cases. All of these attach to your property and must be resolved before you can sell with clear title. Title companies search for these during escrow to make sure buyers know about any claims against the property.

Ways to Record Deeds

You can record documents in person at the American River Drive office. Bring your original deed and payment. The clerk checks it meets recording standards, collects the fee, and processes it while you wait. You leave with your recorded copy showing the official stamp and recording information.

Mail recording is another option. Send your original document with a check or money order to Sacramento County Clerk-Recorder, 3636 American River Drive, Suite 110, Sacramento CA 95864. Include a self-addressed stamped envelope if you want the deed mailed back after recording. Processing takes one to two weeks depending on mail volume and office workload.

Electronic recording is available through certified vendors. Title companies and law firms use this method daily. They upload deed images electronically, and the system records them within hours if submitted before the cutoff time. This costs more than paper recording but saves significant time. Documents submitted after 3pm record the next business day regardless of method.

All documents must meet California formatting standards. One-inch margins on the sides and bottom, three inches at top for the recorder stamp. Text must be at least 8-point font and legible when copied. Signatures need notarization with the notary's commission number and expiration date clearly shown. Missing these requirements causes rejection and delay.

Documentary Transfer Tax

California charges a documentary transfer tax when property changes hands for money or other valuable consideration. The rate is 55 cents per $500 of the sale price. If you sell a home for $450,000, the calculation is $450,000 divided by $500, times $0.55, which equals $495 in transfer tax. This gets paid at recording time.

Certain transfers are exempt from tax. Gifts with no consideration. Transfers between spouses due to divorce or separation. Transfers to satisfy a debt that existed before the transfer. You must declare the exemption reason on the deed or state the full value. False declarations can result in penalties and back taxes owed.

Sacramento County does not impose additional city transfer taxes like coastal urban areas. The standard state rate applies throughout the county. This keeps transaction costs lower compared to places like San Francisco, Oakland, or Los Angeles where city taxes can double or triple the total transfer tax burden.

Cities in Sacramento County

Sacramento County includes several incorporated cities. All property deeds within city limits must be recorded with the Sacramento County Clerk-Recorder. Major cities over 100,000 population include:

Other cities in the county include Citrus Heights, Folsom, Rancho Cordova, and Galt. These cities fall below the 100,000 population threshold but all deed recording happens at the same county office regardless of city size or location within county boundaries.

Adjacent Counties

Properties outside Sacramento County boundaries require recording in neighboring counties: