Yolo County Property Deed Records

Yolo County deed records are kept by the Clerk-Recorder office in Woodland. You can search their online database from 1960 to present at https://yolocountyca-web.tylerhost.net/web/ using Tyler Technologies search portal. The office is at 625 Court Street, Room B01, in Woodland. Call them at 530-666-8130 or email clerk-recorder@yolocounty.gov. This Central Valley county includes agricultural land, the city of Davis home to UC Davis, and the county seat of Woodland. Property types range from farms and orchards to suburban homes and university housing. Electronic recording is available through CeRTNA for faster processing.

Yolo County Quick Facts

Clerk-Recorder Office

The Yolo County Clerk-Recorder handles all property document recordings. Their office sits at 625 Court Street, Room B01, in Woodland. Reach them at 530-666-8130 or email clerk-recorder@yolocounty.gov. They process deeds, deeds of trust, liens, and other land documents that establish or change property ownership. The office keeps regular business hours Monday through Friday.

When you record a deed in Yolo County, staff review it for proper formatting. California law requires specific margins, clear signatures, and correct notarization. These standards come from California Government Code Section 27201 which says the recorder shall accept for recordation any instrument authorized by statute upon payment of proper fees and taxes. If your deed meets the rules, they stamp it with the official date and time, assign a document number, and enter it in the public index.

Yolo County has kept land records for over a century. Early deeds are on paper and stored in bound volumes or on microfiche. Modern records from 1960 forward are digital and searchable online through the Tyler Technologies portal. If you need an old deed from before 1960, you may have to visit the Woodland office in person or request copies by mail. Staff can help locate files but cannot give legal advice about which deed type to use or how to fill out forms. For legal help, consult an attorney or title company.

Search Deeds Online

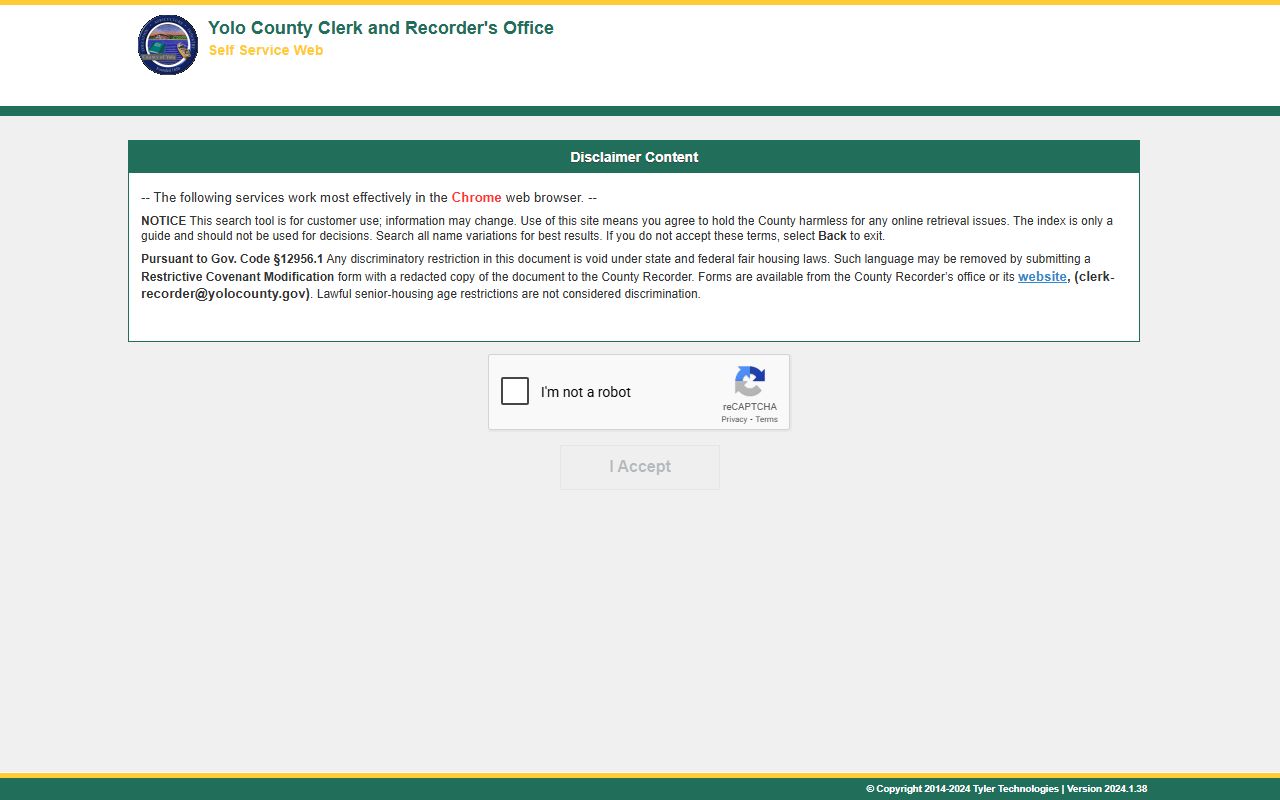

Yolo County uses Tyler Technologies to host their online deed database at https://yolocountyca-web.tylerhost.net/web/ where you can search records from 1960 to present. Search by grantor name, grantee name, or document number. The system shows when documents were recorded and what type they are. This is the fastest way to find property ownership information.

To search by name, type the last name first, then the first name. The results show a list of all matching documents with recording dates and document numbers. Click on a result to see more details like parties involved, book and page numbers, and document type. The index is free to view. If you need a copy of the full document, you may have to pay or request it from the office.

Electronic recording is available in Yolo County through CeRTNA and other certified vendors. Title companies and law firms use eRecording to submit deeds without mailing paper or driving to Woodland. The documents are reviewed by staff just like paper filings. Most eRecordings process faster than mail, often within a day or two. The state oversees eRecording through the California Attorney General's Electronic Recording Delivery System program which certifies vendors and sets security standards.

Fees and Costs

Recording fees in Yolo County follow the standard California structure. The base fee is set by California Government Code Section 27361 which caps the fee at $10 for the first page and $3 for each additional page, though counties may add fees for fraud prevention, affordable housing, and other programs. Expect to pay around $14 to $20 for the first page plus $3 per extra page.

If your deed involves a real estate transfer with a purchase price, add the $75 SB2 housing fee. This fee funds affordable housing under the Building Homes and Jobs Act. The maximum is $225 per document. Documentary transfer tax is 55 cents per $500 of the sale price or consideration. This is the standard rate set by California Revenue and Taxation Code Section 11911 which requires a tax at the rate of $0.55 for each $500 or fractional part thereof when consideration exceeds $100.

Copy fees are lower than recording fees. A plain copy costs a few dollars per page. Certified copies cost more because they include the county seal and signed certification from the recorder. You need certified copies for court cases or loan applications. Plain copies work fine for personal reference or research.

Common Deed Types

Grant deeds are the standard form for property sales in Yolo County. When you buy a home or farm, the seller gives you a grant deed. This type carries implied warranties under California law. The seller promises they own the property and have not sold it to anyone else. They also promise there are no liens or claims against it except those listed in the deed. These warranties are defined by California Civil Code Section 1113 which sets out what legal promises come with the word "grant."

Quitclaim deeds transfer property with no warranties or promises. The grantor just gives up whatever interest they have, if any. People use these for family transfers, divorce settlements, or clearing title defects. If you inherit property with siblings and want to give them your share, a quitclaim deed handles that. Or if an old deed has a spelling error, you can quitclaim it to yourself with the correct name.

Deeds of trust show up in the index when you get a mortgage. This document gives the lender a security interest in your property. If you do not pay, they can foreclose. When you pay off the loan, the lender files a reconveyance deed to release their claim. Both documents are recorded so anyone searching the title can see the loan history.

Other documents in the recorder index include liens from unpaid taxes or contractor bills, easements that let others cross your land, and covenants, conditions, and restrictions that tell you what you can and cannot do with your property. All of these affect your title and appear in searches.

California Property Transfer Law

All real property transfers in California must be in writing. California Civil Code Section 1091 requires that an estate in real property can be transferred only by operation of law or by an instrument in writing subscribed by the party disposing of the same. You cannot transfer land with a verbal promise. It must be a signed, written deed.

Recording protects you from later competing claims. California has a race-notice statute at California Civil Code Sections 1213-1214 which provides that every conveyance recorded is constructive notice to subsequent purchasers and mortgagees. If someone else also claims to own your property, the first person to record their deed usually wins. Recording puts the whole world on notice of your ownership.

Nearby Counties

If the property you need is not in Yolo County, try these neighboring counties: