San Francisco Deed Records

San Francisco County deed records are maintained by the Office of the Assessor-Recorder located in City Hall. This is unique because San Francisco is both a city and county, so there is one recorder office for the entire area. You can search property ownership documents online for free through their Records Manager system which covers deeds from 1990 to the present. The office serves over 870,000 residents in the most densely populated major city in California. Online viewing is free for documents in the database, which is more generous than many counties that charge fees. The office is at City Hall, Room 190, 1 Dr. Carlton B Goodlett Place. San Francisco has some of the highest transfer tax rates in the state with tiered rates that can reach 6% for properties valued over $25 million.

San Francisco County Quick Facts

Assessor-Recorder Office

The San Francisco Office of the Assessor-Recorder handles all deed recordings for the city and county. The office is in City Hall at Room 190, 1 Dr. Carlton B Goodlett Place, San Francisco, CA 94102. You can reach them at (415) 554-5596 for questions about recording or document requests. Staff help with basic procedural questions but cannot provide legal advice.

For details about services and online access, visit the main recorder page where you can find information about recording requirements, fees, and links to the Records Manager database for searching San Francisco property documents.

San Francisco combines city and county functions in one government. There is no separate county outside the city limits. This makes things simpler because there is only one recorder office for the entire jurisdiction. All deeds, liens, and other property documents for San Francisco get filed at City Hall.

The office processes a high volume of real estate transactions. Property values in San Francisco are among the highest in the nation. Recording fees and transfer taxes generate significant revenue for the city. The office has modernized its systems and offers electronic recording through certified vendors for faster processing.

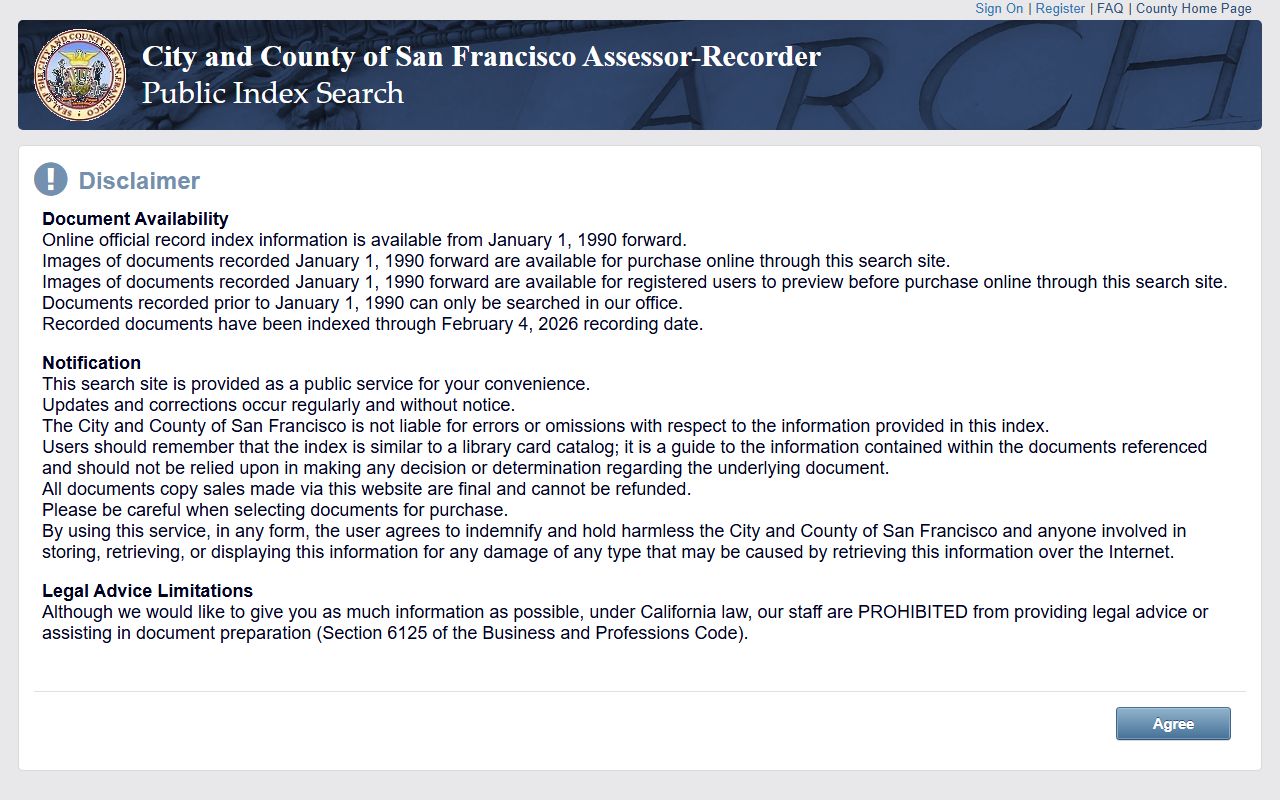

Free Online Records Access

San Francisco offers free online viewing of deed records from 1990 to the present. The Records Manager database lets you search by grantor name, grantee name, document number, or recording date. You can view and print documents at no charge. This is more generous than many counties that charge fees to view images.

To search property records for free, access the Records Manager database where you can look up deeds and other documents recorded in San Francisco from 1990 forward and view full document images without paying fees.

The system is easy to use. Type in a name or document number. The search returns matching results. Click on a result to see details. You can then view the actual document image. Download it or print it if you need a copy. The online copy is not certified, but it works for most purposes where you just need to see what was recorded.

Copy fees for official copies are $1.81 online. In-person copies cost $9.70 for the first page and $0.39 for each additional page. Certified copies add a certification fee. If you need a certified copy for legal proceedings or to submit to a government agency, you must order it through the office and pay the applicable fees.

For documents recorded before 1990, you need to visit City Hall in person or contact the office. Older records may be on microfilm or in paper archives. Staff can help you locate historical deeds if you provide the address or assessor parcel number. Searching older records takes longer because they are not in the online system.

Recording Fees and Transfer Tax

Recording a deed in San Francisco costs $14 for the base fee. With the fraud prevention fee, it is $17 for the first page. The SB2 affordable housing fee of $75 applies to most residential transfers, with a maximum of $225 for higher value properties. Additional pages cost $3 each. A typical grant deed runs about $90 to $100 to record when you add up all fees.

San Francisco has the highest transfer tax rates in California. The tax is tiered based on property value. Lower value properties pay less per dollar. Higher value properties pay much more. For properties sold at $25 million or above, the transfer tax rate can reach 6%. This generates substantial revenue for the city but makes closing costs very high for expensive real estate.

The transfer tax applies to the full sale price or consideration. If you sell a condo for $2 million, you pay the applicable rate on the full $2 million. For a $30 million luxury home, the transfer tax alone could be $1.8 million. These costs are typically negotiated between buyer and seller. In some cases the seller pays. In others it is split or the buyer pays. Your purchase contract should specify who pays the transfer tax.

Property Deed Types

Grant deeds are standard for home sales in San Francisco. The seller grants the property to the buyer. California law implies warranties with this deed. The seller promises they have not sold to anyone else and there are no hidden liens except those disclosed. These warranties protect buyers from certain title defects.

Quitclaim deeds give no warranties. The grantor transfers whatever interest they have, if any. People use quitclaim deeds for family transfers, divorce settlements, or clearing title issues. If you accept a quitclaim deed, you take the property as is with no promises. Title insurance is important with quitclaim deeds.

Deeds of trust are loan documents. When you get a mortgage, you sign a deed of trust. It gives the lender a security interest in your property. The lender can foreclose if you do not pay. After you pay off the loan, the lender files a reconveyance to release their claim. Deeds of trust show up in title searches even though they are not ownership deeds.

Liens, easements, and covenants also get recorded. Tax liens from government agencies. Mechanic liens from contractors. Utility easements. HOA restrictions. All these documents affect property rights. A thorough title search reviews everything recorded against the property before a sale can close.

Transfer on death deeds let you name a beneficiary to inherit your property without probate. You file the deed while alive but it does not take effect until you die. You can change or cancel it any time. This estate planning tool has become popular because it is simple and avoids probate delays and costs.

City and County of San Francisco

San Francisco is the only city-county in California that is completely coterminous. The city limits match the county limits exactly. There are no unincorporated areas and no other cities within the county. This makes property records simpler because there is only one recorder office for the entire jurisdiction.

For more information about San Francisco as a city, see the San Francisco city page which has details about local services and resources.

Nearby Counties

If your property is located outside San Francisco, check these neighboring counties: