Concord Deed Records Search

Concord property deeds are recorded with Contra Costa County Elections Division Recorder in Martinez. The city of Concord has no deed recording office. All real estate transactions in Concord go through the county system. Contra Costa County maintains deed records for 19 cities including Concord, Richmond, Antioch, and Walnut Creek. You can search these records online or request copies from the county office. Concord is located in central Contra Costa County about 29 miles east of San Francisco. The city has approximately 129,000 residents spread across 31 square miles. Concord sits in the East Bay region and serves as a bedroom community for San Francisco and Oakland with good BART access to both cities.

Concord Quick Facts

Contra Costa County Recorder

Contra Costa County Elections Division Recorder handles all deed filings for Concord. The office is at 555 Escobar Street in Martinez, the county seat. This is about 11 miles west of Concord. Call 925-335-7900 for questions about recording or to request copies of documents.

The office is open Monday through Friday during regular business hours. You can submit documents in person, by mail, or through electronic recording systems. Most real estate professionals use eRecording for speed and reliability. Documents submitted electronically typically get recorded within two business days.

According to information from the county, documents are recorded within two business days after submission. The average turnaround time for getting recorded documents back is 30 days. This includes the time to process, record, and return the documents to you or your title company.

For comprehensive information about Contra Costa County recording, visit the Contra Costa County deed records page which includes details about recording fees, online search access, fraud notification programs, eRecording options, and how to request certified copies of property documents for Concord and all other cities in the county.

Online Deed Search for Concord

Contra Costa County offers online deed searches through the CRIIS system. Go to the Contra Costa County online records database to search for Concord property records. You can search by name, address, or document details.

To search by owner name, enter the last name first. The system returns all matches with basic information like recording date and document type. You can view index information for free. Full document images may require payment or a request to the recorder office.

Most Concord home sales use grant deeds. A grant deed transfers ownership from seller to buyer with implied warranties that the seller owns the property and has not conveyed it to anyone else. These warranties are automatic under California law even if not written in the deed. Quitclaim deeds are used for transfers between family members or to clear title problems. They give no warranties.

The online system covers all of Contra Costa County. When you search, you may see deeds from other cities if the person owns property in multiple locations. Check the address or legal description to confirm you have the right property in Concord.

Recording Fees in Concord

Contra Costa County charges $14 for the first page of a deed. Add $3 for each additional page. There is also a $3 fraud prevention fee. So a one-page deed costs $17 total. A three-page deed costs $23. These fees apply county-wide including Concord.

The SB2 housing fee of $75 applies to most real estate documents. This state-mandated charge funds affordable housing throughout California. Every county collects it. The maximum SB2 fee is $225 for transactions involving three or more parcels.

Copy fees depend on whether you need certification. Plain copies are cheaper but cannot be used for legal purposes. Certified copies include the county seal and a signed statement from the recorder. They cost more but are required for court filings, refinancing, or title insurance.

If you use electronic recording through a vendor, the vendor may charge service fees on top of county recording fees. Most title companies absorb these costs as part of their closing services. Ask for a full breakdown of recording costs before you close on Concord property.

Concord Transfer Tax

Concord does not have a city transfer tax. You pay only the county documentary transfer tax of 55 cents per $500 of the sale price. For a $750,000 home, the transfer tax is $825. This is much lower than nearby cities like Richmond which charges additional city transfer taxes ranging from $7 to $30 per $1,000.

The seller typically pays transfer tax at closing unless the parties negotiate otherwise. The tax is based on the net consideration. If a buyer assumes an existing mortgage, that loan amount does not count toward the taxable value.

Transfer tax is collected when the deed is recorded. The county stamps the tax amount on the recorded document. This becomes part of the public record and anyone can calculate the approximate sale price by looking at the transfer tax.

Do not confuse transfer tax with property tax. Property tax is an annual charge based on assessed value. Transfer tax is a one-time fee charged only when ownership changes. Certain transfers like gifts between spouses or parents and children may qualify for transfer tax exemptions.

California Grant Deed Warranties

California law creates automatic warranties when someone uses a grant deed to transfer property. The California Civil Code Section 1113 states that the word "grant" implies the grantor has not conveyed the property to anyone else and that the estate is free from encumbrances made by the grantor.

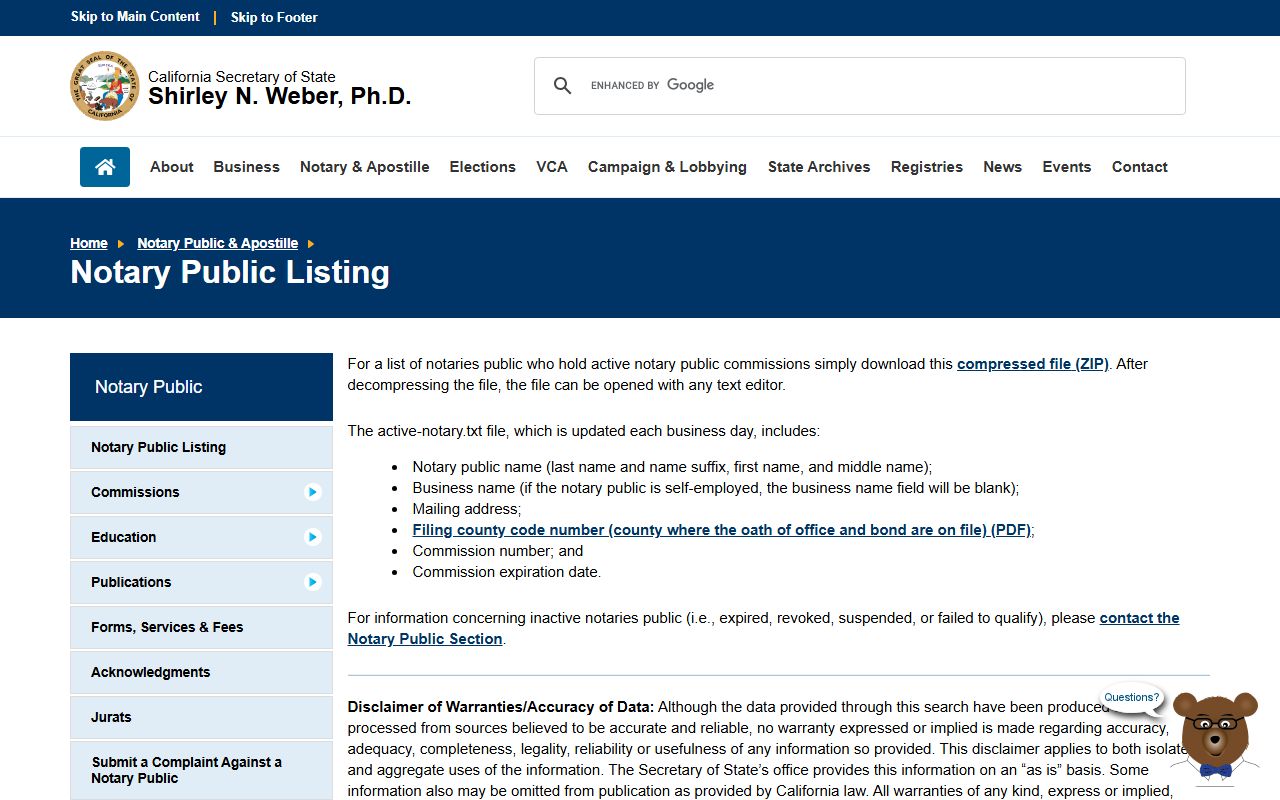

Most deeds in Concord require notarization before the county will accept them for recording. You can verify a notary's commission status through the California Secretary of State notary listing before having your deed notarized.

Other Contra Costa County Cities

Contra Costa County has 19 incorporated cities. All use the county recorder in Martinez. Below are other major cities near Concord:

Note: Richmond and Antioch have additional city transfer taxes. Concord does not charge city transfer taxes so transaction costs are lower.