Contra Costa County Deeds

Contra Costa County deed records are kept at the County Clerk-Recorder office in Martinez, which serves over 1.1 million residents across 19 cities and unincorporated areas in the East Bay. You can search property ownership documents online through their database system. The office is located at 555 Escobar Street in Martinez and handles all real property recordings for the entire county. Most deed searches use grantor or grantee names to find ownership transfers. Documents are typically recorded within two business days of submission, and the average turnaround time for processing is 30 days according to the office. Richmond and El Cerrito are two cities in this county that charge their own city transfer taxes on top of the standard county rate.

Contra Costa County Quick Facts

County Recorder Office

The Contra Costa County Clerk-Recorder office handles all deed recordings for the county. The office is at 555 Escobar Street in Martinez, California 94553. You can call them at 925-335-7900 with questions about recording procedures, fees, or document requests. Staff provide basic information but cannot give legal advice about which type of deed to use or how to prepare documents.

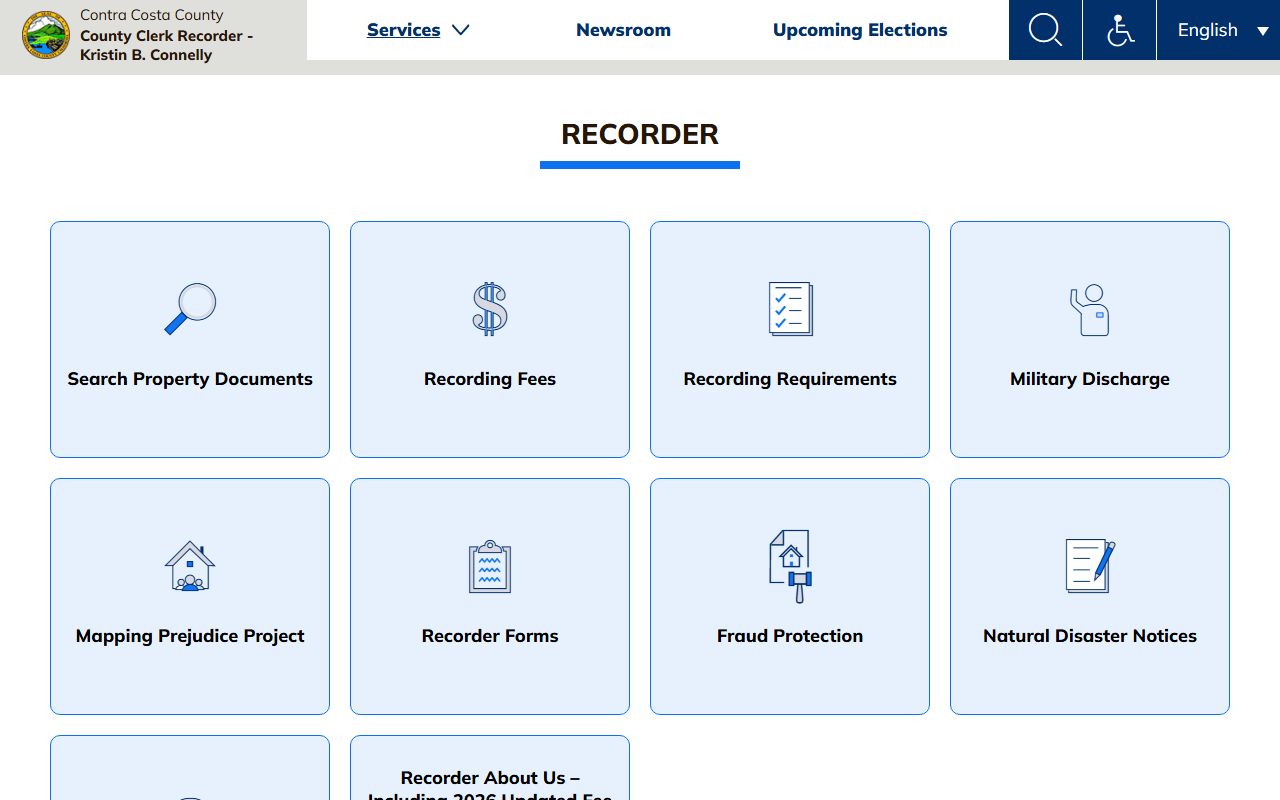

For information about services and recording requirements, visit the main recorder page where you can find details about fees, hours, document standards, and links to online search tools for Contra Costa County property records.

According to the office, documents are recorded within two business days of submission. The average turnaround time for complete processing is 30 days. This means you will get your recorded deed back about a month after filing it. Electronic recording is faster and most professional users choose that option for quicker processing and confirmation.

When you submit a deed for recording, staff review it for proper formatting. Documents must meet California standards for margins, font size, and legibility. The notarization must be complete and valid. If any required information is missing or incorrect, the recorder will reject the document and return it with instructions for corrections.

The office offers a fraud notification program. Property owners can sign up to receive alerts when documents affecting their property are recorded. This helps detect fraudulent deeds or liens filed against your property. The service is free and provides an extra layer of protection against property fraud schemes.

Online Database Search

Contra Costa County maintains an online database of recorded documents. The system uses CRIIS software hosted at a third-party site. You can search by grantor name, grantee name, document number, or date range. Basic searches are free and show index information like recording date and parties involved.

Viewing full document images may require payment depending on the type of record and how you access it. The system shows what is available and any associated fees before you commit to a purchase. You can buy individual documents or order certified copies if you need them for official purposes.

For older records that predate the online system, you need to visit the Martinez office in person. Historical deeds may be on microfilm or in paper archives. Staff can help you locate documents if you have the property address, legal description, or approximate recording date. Searching older records takes more time because they are not computerized.

Fees and Transfer Taxes

Recording a deed in Contra Costa County costs $14 for the base fee plus $3 for the fraud prevention fee. Additional pages are $3 each. A two-page grant deed would cost $14 + $3 + $3 = $20 before adding the SB2 fee. Most residential property transfers also include the $75 SB2 affordable housing fee, bringing the total to about $95.

Documentary transfer tax at the county level is 55 cents per $500 of the purchase price. But two cities in Contra Costa County have their own city transfer taxes that are much higher. Richmond charges $7 to $30 per $1,000 depending on property value with a four-tier system. El Cerrito charges $12 per $1,000. These city taxes add significant costs to property sales in those areas.

If you buy a home in Richmond for $800,000, the city transfer tax could be $12,000 or more depending on which tier applies. This is on top of the county transfer tax and all recording fees. Buyers and sellers need to know about these extra costs before agreeing on a purchase price. The escrow company will calculate exact amounts at closing.

Common Property Deeds

Grant deeds are what most people use when buying or selling real estate. The seller grants the property to the buyer. California law implies certain promises with this deed type. The seller warrants they have not conveyed the property to anyone else and there are no undisclosed liens except those mentioned in the deed or already in public records. These implied warranties give buyers some legal protection.

Quitclaim deeds transfer only the interest the grantor has, with no promises about what that interest is or whether it even exists. People use quitclaim deeds to fix title problems, transfer property between family members, or remove an ex-spouse from title after divorce. You should always get title insurance when accepting a quitclaim deed because you have no warranties about the property.

Trust deeds are not ownership documents. They are security instruments for loans. When you take out a mortgage, you sign a deed of trust that gives the lender a claim on your property. If you default, the lender can foreclose through the trustee named in the deed. When you pay off the loan, the lender files a reconveyance to release their security interest.

Other documents in the recorder system include liens, easements, and restrictions. Mechanic liens from contractors who were not paid. Tax liens from government agencies. Utility easements. HOA covenants, conditions, and restrictions. All of these create rights or restrictions that affect the property and must be disclosed in title reports.

Cities in Contra Costa County

Contra Costa County has 19 cities. All property deeds are recorded at the county office in Martinez. Below are the largest cities:

Note: Richmond and El Cerrito charge significantly higher city transfer taxes than the standard county rate.

Nearby Counties

If the property is not in Contra Costa County, check these neighboring counties: