Find Fresno County Deed Records

Fresno County deed records are maintained by the County Recorder office on Tulare Street in downtown Fresno. The recorder maintains property deeds, transfers, liens, and related land documents for all areas within county boundaries. You can search these files online through their Tyler Technologies database or visit the office in person during business hours. Most people use the online portal to find deed information by searching grantor or grantee names, document numbers, or property legal descriptions. The county sits in the heart of California's Central Valley and serves over 1 million residents across cities like Fresno, Clovis, and many unincorporated farming communities.

Fresno County Quick Facts

County Recorder Information

The Fresno County Recorder operates from 2281 Tulare Street, Room 302, in downtown Fresno. Their phone number is (559) 600-5956. Staff process all deed recordings for the county. When you buy or sell land in Fresno County, the deed must be filed here to transfer ownership officially. The recorder stamps each document with the date and time received, assigns a unique document number, and indexes it by grantor and grantee names so the public can search later.

This office handles more than just deeds. They also record deeds of trust, reconveyances, liens, easements, subdivision maps, and other land-related documents. Business owners file fictitious business name statements here. The recorder section works separately from the county clerk section, though both may share the same building in some counties. For deed work, you want the recorder.

Recording fees in Fresno County are $19 for the first page on most documents. If you record a deed that involves a property transfer, the fee is only $11 for the first page because documentary transfer tax gets added separately. Each page after the first costs $3. A three-page grant deed would cost $11 + $6 = $17 in recording fees, plus transfer tax based on the sale price.

The office follows standard California rules under Government Code Section 27201 and related statutes. According to California Government Code Section 27361, counties can charge up to $10 for the first page and $3 for each additional page, though many counties add extra fees for fraud prevention, affordable housing, and other state-mandated programs. Fresno keeps fees relatively low compared to larger urban counties.

Search Deed Records Online

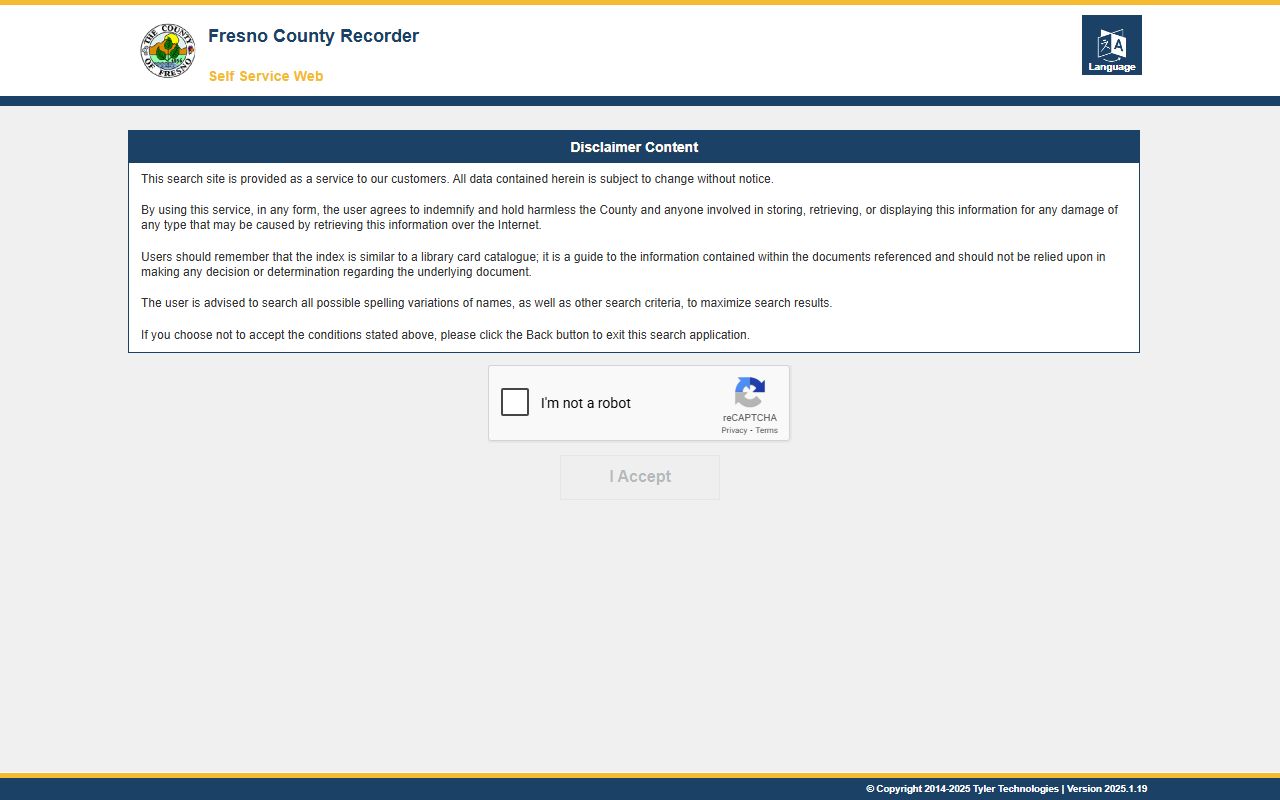

Fresno County uses Tyler Technologies to host their online database. You can search deed records without creating an account or paying upfront fees. The database lets you search by name, document type, date range, and other criteria. Most searches return results within seconds.

To access the Fresno County online deed database, visit the Tyler search portal where you can look up recorded documents by grantor/grantee names, document numbers, or legal descriptions at no initial cost through their public access system.

The system shows basic information for free. You can see who granted property to whom, the recording date, document number, and document type. If you need to view the actual deed image, you must pay a fee. The county charges per page for digital copies. Certified copies cost more than plain copies.

Tyler Technologies powers many Central Valley county recorders. The interface looks similar whether you search in Fresno, San Joaquin, or other counties using the same vendor. Once you learn how to use it in one county, you can easily search records in others. The system runs 24 hours a day except during scheduled maintenance windows.

If you need help using the online system, call the recorder office during business hours. Staff can walk you through the search process over the phone. They cannot interpret legal documents or give advice about which type of deed you should use, but they can explain how to find what you need in the database.

Types of Property Documents

Grant deeds transfer ownership from one person to another. These are the standard deed type in California real estate sales. When you buy a house in Fresno County, you receive a grant deed. Under California Civil Code Section 1113, grant deeds include implied promises that the seller has not transferred the property to anyone else and that no hidden liens exist beyond those disclosed.

Quitclaim deeds transfer whatever interest the grantor has without any promises. People use these for transfers between family members, clearing title defects, or resolving ownership disputes. If you inherit property with your siblings and later decide one person should own it all, the others might quitclaim their shares to that person. No money changes hands and no warranties are made.

Deeds of trust are loan documents. When you get a mortgage to buy property, you sign a deed of trust giving the lender a security interest. If you fail to pay, they can foreclose. After you pay off the loan, the lender files a reconveyance deed releasing their claim. Both the original deed of trust and the reconveyance show up in the recorder index.

The recorder also files liens. These can be mechanic's liens from contractors who did work on your property and did not get paid. Tax liens from the IRS or Franchise Tax Board. HOA liens for unpaid association dues. Judgment liens from court cases. All of these attach to property and must be cleared before you can sell with clean title.

How to Record Documents

You can record deeds in person, by mail, or electronically through approved vendors. Most title companies use eRecording for speed and convenience. The document uploads instantly and gets recorded the same day if submitted before the cutoff time. Staff review it and either accept or reject based on formatting requirements.

If you record by mail, send your original document plus the recording fee to 2281 Tulare Street, Room 302, Fresno CA 93721. Include a self-addressed stamped envelope if you want the recorded deed mailed back. Processing takes one to two weeks depending on volume. Do not send cash through the mail. Use a check or money order made payable to Fresno County Recorder.

Recording in person is fastest if you live nearby. Bring your original document and payment. The clerk checks it for proper formatting, calculates the fee, and processes it on the spot. You get your recorded copy back the same day. The office accepts cash, checks, and credit cards. Some credit card companies charge a processing fee on top of the county fee.

Documents must meet California recording standards. They need one-inch margins on all sides except the top, which requires three inches for the recorder stamp. Text must be legible. Signatures must be notarized unless the document type does not require it. The notary acknowledgment must show the notary commission number and expiration date. Missing any of these can cause rejection.

Under California Civil Code Section 1091, all transfers of real property must be in writing and signed by the person transferring the interest. Verbal agreements to sell land are not valid. The deed must be delivered and accepted to complete the transfer, though recording is not required for validity between the parties. Recording protects you against later claims by third parties.

Documentary Transfer Tax

California law imposes a transfer tax when property changes hands for consideration. The rate is 55 cents per $500 of the sale price or property value. If you sell a house for $300,000, the transfer tax is $300,000 divided by $500, times $0.55, which equals $330. This tax must be paid when you record the deed.

Some transactions are exempt. Transfers between spouses due to divorce are exempt. Gifts with no money changing hands are exempt. Transfers to pay off a debt are exempt if the debt existed before the transfer. The deed must state the exemption reason or declare the full cash value. Making false statements about consideration or exemptions can result in penalties.

The transfer tax gets split between the county and state. Cities within Fresno County do not impose additional city transfer taxes, unlike San Francisco or Los Angeles where city taxes can exceed the county amount. This keeps closing costs lower in Fresno County compared to coastal urban areas.

Cities in Fresno County

Fresno County contains 15 incorporated cities. All property deeds within these city limits must be recorded with the Fresno County Recorder. The largest cities over 100,000 population are:

Other cities in the county include Coalinga, Firebaugh, Fowler, Huron, Kerman, Kingsburg, Mendota, Orange Cove, Parlier, Reedley, San Joaquin, Sanger, and Selma. These smaller cities do not have separate pages because they fall under the 100,000 population threshold, but all deed work for properties within their boundaries goes through the same Fresno County Recorder office.

Nearby Counties

If your property sits outside Fresno County boundaries, check these neighboring counties: