Kings County Deed Records

Kings County deed records are maintained by the County Clerk-Recorder office at 1400 West Lacey Boulevard in Hanford. The recorder keeps property deeds, transfers, liens, and other land documents for all areas within county boundaries. Due to AB 1785 privacy legislation, Kings County does not offer online access to deed records. You must visit the office in person or call to request information during business hours. Staff can search their system and provide copies of deeds for a fee. The county serves over 150,000 residents in cities like Hanford, Lemoore, and Corcoran. All deed work for properties throughout this agricultural county in the southern San Joaquin Valley goes through the Hanford office.

Kings County Quick Facts

Clerk-Recorder Office Information

The Kings County Clerk-Recorder office is located at 1400 West Lacey Boulevard in Hanford. You can reach them at (559) 852-2470 or by email at ClerkRecorder@co.kings.ca.us during business hours. This office handles all property deed recordings for Kings County. When you buy or sell land anywhere in the county, the deed must be filed here to transfer ownership officially.

Kings County implemented AB 1785 privacy restrictions. This legislation prohibits online public access to certain property records including deed indexes searchable by assessor parcel number or other identifying information. As a result, the county does not offer online deed searching. You must visit the office in person or contact staff by phone to request deed information.

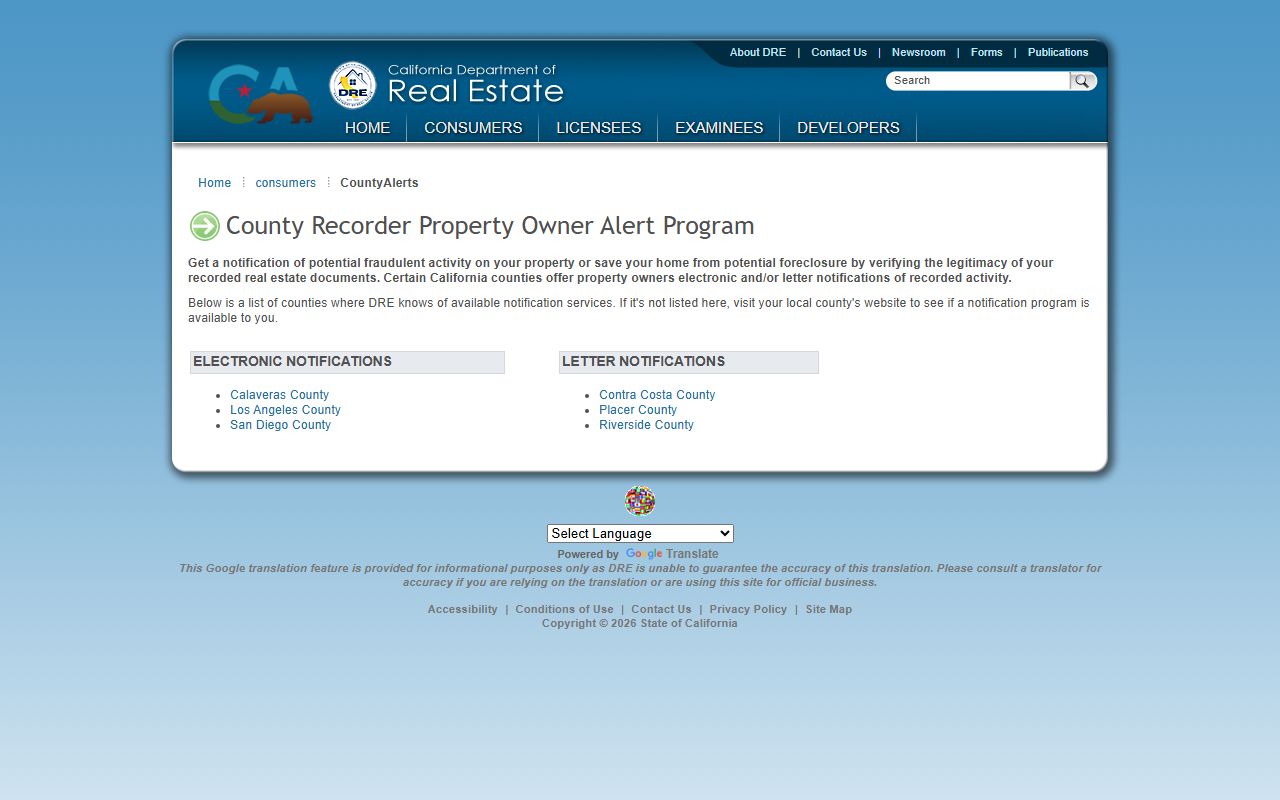

To understand how California's fraud alert programs help protect property owners, visit the DRE County Recorder Alert Program page where you can find information about county notification services that alert homeowners when documents are recorded against their property, helping detect potential fraudulent activity.

Many California counties offer property fraud notification programs. When someone records a deed or other document affecting your property, the county sends you an alert by email or mail. This helps detect fraud quickly. Contact the Kings County Recorder to ask if they offer this service and how to enroll.

Recording fees in Kings County follow California state guidelines. The base fee typically ranges from $14 to $20 for the first page depending on document type. Each additional page costs $3. The county also collects state-mandated fees for fraud prevention and affordable housing. Documentary transfer tax is calculated separately based on property value or sale price.

How to Access Deed Records

Visit the office at 1400 West Lacey Boulevard during business hours. Staff can search their internal system for deeds by name, property address, or assessor parcel number. Bring as much information as you have about the property or transaction. This helps staff locate the right records quickly.

You can also call (559) 852-2470 to request information over the phone. Staff can tell you if a deed exists and what it would cost to get a copy. They can mail copies for a fee if you cannot visit in person. Expect to pay for staff time and copies. Certified copies cost more than plain copies.

For urgent deed research, in-person visits work best. You can review records immediately and get copies the same day. Phone requests take longer because staff must search, copy, and mail documents. Plan ahead if you need deeds for a closing or legal matter with a deadline.

California law protects public access to recorded documents under Government Code Section 27201, but AB 1785 allows counties to restrict online access for privacy reasons. You still have the right to view and copy records, you just cannot search them online like you can in counties without AB 1785 restrictions.

Types of Property Deeds

Grant deeds transfer ownership with limited warranties. The grantor promises they have not previously conveyed the property and that no hidden encumbrances exist beyond those disclosed. California Civil Code Section 1113 establishes these implied warranties from the word "grant." Most residential sales use grant deeds.

Quitclaim deeds provide no warranties. The grantor releases whatever interest they have without making promises about title quality. These work well for transfers between relatives, clearing title defects, or divorce situations. No money typically changes hands with quitclaim deeds.

Deeds of trust secure mortgage loans. When you finance a home purchase, you sign a deed of trust giving the lender a security interest in the property. If you default, they can foreclose. After paying off the loan, the lender files a reconveyance deed releasing their claim. Both documents appear in the public record.

The recorder also files liens. Tax liens from unpaid taxes. Mechanic's liens from contractors seeking payment. Judgment liens from court cases. All of these attach to property and must be cleared before you can sell with clean title. A title company will search for these during escrow.

How to Record Documents

Recording in person is most direct. Visit 1400 West Lacey Boulevard with your original document and payment. The clerk checks it for proper formatting, calculates the total fee, and processes it immediately. You leave with your recorded copy showing the official stamp and recording information.

You can record by mail if you cannot visit in person. Send your original document plus payment to the address above. Include a self-addressed stamped envelope if you want the deed returned after recording. Processing takes one to two weeks depending on mail volume and office workload. Use a check or money order made payable to Kings County Clerk-Recorder. Never send cash.

Electronic recording may be available through certified vendors approved by the California Attorney General. Contact the office to confirm if they accept electronic submissions and which vendors they work with. Title companies and attorneys often use this method for speed and reliability.

All documents must meet California recording standards. One-inch margins on sides and bottom, three inches at top for the recorder stamp. Text must be legible in at least 8-point font. Signatures require notarization with the notary's commission number and expiration date shown. Missing any requirement causes rejection and delay.

California law requires property transfers to be in writing. Civil Code Section 1091 states that real property estates can only transfer by operation of law or by written instrument signed by the person disposing of the interest. Recording provides constructive notice to protect your ownership rights.

Documentary Transfer Tax

Transfer tax applies when property sells for money or other consideration. California charges 55 cents per $500 of the sale price. If you sell a home for $260,000, the calculation is $260,000 divided by $500, times $0.55, which equals $286 in transfer tax payable at recording.

Certain transfers are exempt. Gifts where no money changes hands. Transfers between spouses due to divorce or legal separation. Transfers to satisfy a debt that existed before the transfer. The deed must declare the exemption reason or state the full cash value. False statements about consideration can result in penalties.

Kings County does not impose additional city transfer taxes. The standard California rate applies throughout the county. This keeps transaction costs lower compared to coastal urban areas where cities add substantial transfer taxes on top of the basic state and county rates.

Cities in Kings County

Kings County includes several incorporated cities. All property deeds within city limits must be recorded with the Kings County Clerk-Recorder in Hanford. No cities in Kings County exceed the 100,000 population threshold.

Cities in the county include Hanford, Lemoore, Corcoran, and Avenal. Properties within these city limits and throughout unincorporated county areas all require recording with the Kings County Clerk-Recorder office.

Note: The county serves a primarily agricultural region in the southern San Joaquin Valley with significant dairy and crop production.

Adjacent Counties

If your property lies outside Kings County boundaries, check these neighboring counties: